THE BEGINNING OF recovery from the COVID-19 pandemic may be just around the corner for the U.S. hotel industry, but that doesn’t mean a return to normal, according to a survey from marketing firm Hotel Recovery and analytics company SHR. Instead, hotels are adapting to the new market environment using technology and operational strategies.

Soliciting responses from readers of Hotel Recovery’s daily email newsletter and hotels in SHR’s network, the survey asked about participants’ strategies for generating demand, use of technology, guest safety, dealing with competition from alternative accommodations and operational efficiencies. The survey was launched in April, when travel still was basically at a standstill due to the outbreak.

“We knew the business outlook wasn’t going to be good. Instead, we wanted to gain some perspective on what strategies hoteliers were using to mitigate the damage of COVID and what plans they were implementing to prepare for returning demand,” Hotel Recovery said in the report. “Because ‘returning to normal’ is no longer an option, we asked hoteliers to shed some light on their current operations and to predict future challenges and opportunities.”

Supplying the Demand

Finding new demand in the current market, and planning for the return of demand once travel resumes, is the lead topic in the survey. It found many hotels are trying new approaches to that problem.

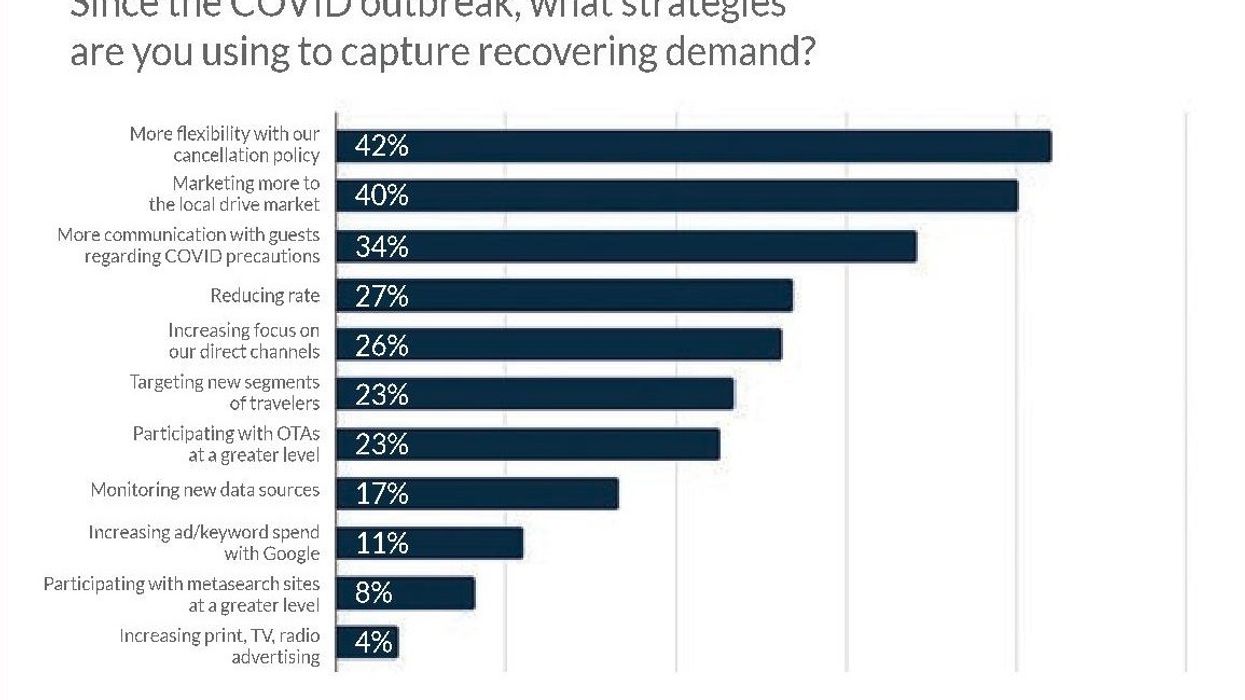

“It was surprising, and satisfying, to see that reducing rate is not the No. 1 strategy hoteliers are using to win back guests. After all, we know price is not what is preventing consumers from taking trips today; rather, it's uneasiness over COVID restrictions and the fear of potentially becoming infected,” the report said. “Therefore, it makes sense that the majority of survey respondents, [42 percent,] said their plans are to be more flexible with cancellation policies. More than ever, travelers today want peace of mind when booking a trip – they want to know that if something should change, they'll be able to alter or cancel plans without severe penalty.”

Around 27 percent of respondents are reducing rates. Other strategies included focusing on the local drive market, 40 percent; increasing communication with guests regarding COVID precautions, 34 percent; catering to direct channels, 26 percent; and targeting new segments of travelers, 23 percent.

Playing it safe

Even after the pandemic finally ends, hotels will have to appease travelers’ heightened desire for sanitary and safe lodging. That can mean tough choices, such as requiring guests to wear masks as well as employees, a step 56 percent of respondents have taken.

“Outside of requiring everyone on property to cover their nose and mouth, many hotels reported implementing additional operational changes aimed at keeping staff and guests safe,” the report said.

“Nearly 50 percent of survey respondents said they have reduced the number of times staff enters the guestroom during stayovers, which translates to less housekeeping. This practice was already accelerating before COVID in attempts to save on labor costs, but now the guest is most likely on board as well because it reduces the opportunity to bring contamination into the room.”

Also, 44 percent of respondents said they require every staff member to check their temperature each day. Another 39 percent have closed or modified their F&B offering while 5 percent required a negative COVID test from all guests. The other strategies involve technology such as contactless check-in and digital room keys.

Turning to tech

While technology can help hotels keep guests and workers safe, it also comes at a literal price in terms of new hardware and software. With budgets weakened by anemic revenue, that can be difficult to achieve.

“But these changes were coming regardless, and without adapting to current and future guest needs, hotels were going to find themselves behind the 8-Ball,” the report said. “The most important technologies in 2020 were guest facing. Twenty-three percent of survey respondents said they were considering contactless check-in solutions and/or digital keys to avoid physical contact between the guest and the front desk. Just behind that, 19.2 percent of hoteliers said they were considering installing a new guest messaging platform so they could communicate with guests in a safer manner.”

Customer relationship management and/or loyalty promotions were being implemented by 19 percent of respondents. Revenue management and/or forecasting systems were installed by 13 percent, workflow automation by 10 percent and property management systems by 9 percent.

Other results of the survey include:

- 27 percent of respondents are planning to automate more daily processes

- 17 percent will implement new workflow management tools

- 9 percent plan to stay fully staffed or return full staff soon

- 39 percent view alternative accommodation options, such as Airbnb and VRBO, as more direct competition in 2020 than in previous years.

- What metric signifies ‘recovery’ for your hotel?

- 3 percent see consistent occupancy over a certain percent as a signifier of recovery, 23.7 percent said consistent RevPAR over a certain amount and 22.2 percent said consistent profitability over a certain amount.

- Most respondents said business was not profitable in the third quarter of 2020.

- Most are not considering changing from brand to independent or vice versa.

In December, CBRE Hotels Research forecast occupancy and ADR should return to 2019 levels by 2024.