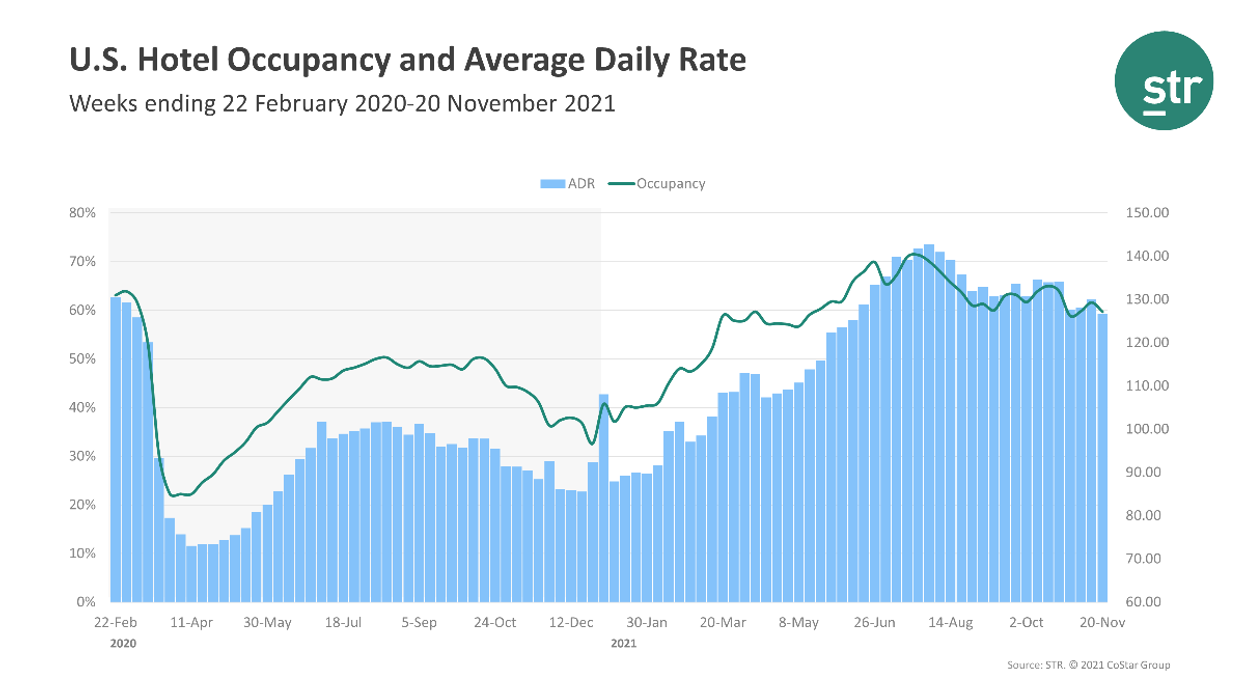

U.S. HOTEL PERFORMANCE moved closer to pre-pandemic levels during the third week of November according to STR. It dipped, however, from the week before.

Occupancy was 59.7 percent for the week ending Nov. 20, down from 61.6 percent for the week before and a slight decrease of 2.1 percent from the same period two years ago.

ADR for the third week of the month was $126.66, down from $129.98 the week before and increased 1.7 percent when compared to two years ago. RevPAR decreased to $75.60 for the third week of the month from $80.02 the week before, and a slight drop of 0.4 percent for the same period in 2019.

Among STR’s top 25 markets, Phoenix saw the largest occupancy increase during the week under review, up 6.4 percent to 76.6 percent over 2019.

Miami reported the largest ADR increase when compared to 2019, 25.5 percent to $207.72.

Oahu Island, Hawaii, experienced the steepest occupancy decline from 2019, down 35.2 percent to 51.8 percent.

According to STR, the largest RevPAR deficits were in San Francisco/San Mateo, down 71.3 percent to $90.81, followed by Oahu Island, down 37.3 percent to $113.55, during the third week of the month.