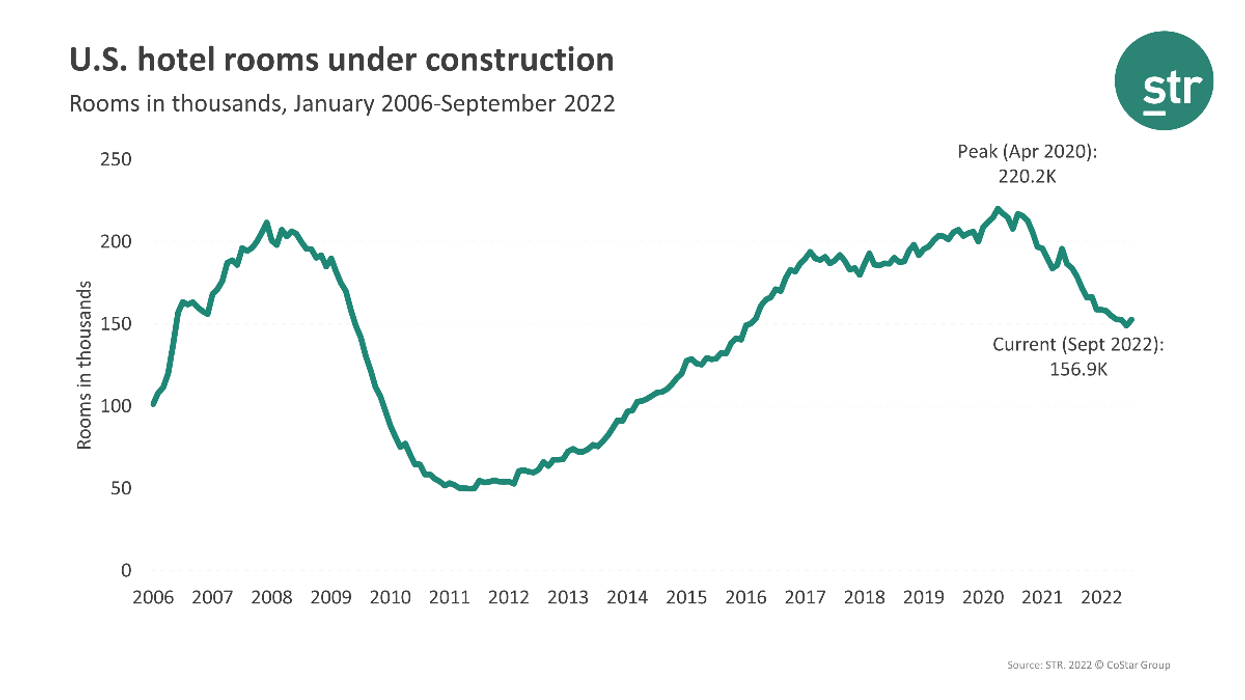

THE U.S. HOTEL construction pipeline ticked up in September for the third consecutive month, according to STR. Also, year-over-year declines have been lessening each month since May.

In STR’s pipeline, 156,861 rooms were in construction during the month, down 8.9 percent from the same time last year. Another 173,932 rooms were in final planning, down 15.5 percent, and 282,225 rooms were planning, up 7 percent.

New York City, Phoenix and Nashville are set to see the largest supply percentage increases from current construction, according to STR. Among the chain scales, the luxury and upscale segments led in that measurement.

“There are plenty of concerns around the industry given the likelihood of a recession, but for most markets, new supply will not be an additional headwind in the short term,” said Alison Hoyt, STR’s senior director of consulting. “Even though the declines have slowed, activity is still down year over year, and the industry is 63,000 rooms below the construction peak from 2020. That places the possibility of new supply increasing competition further out on the horizon.”

Luxury chain scales showed the highest number of rooms as a percentage of existing supply in the in-construction phase of the pipeline. The overall chain scale rankings for September are:

- Luxury (5.7 percent, 7,777 rooms)

- Upscale (4.6 percent, 40,620 rooms)

- Upper Midscale (3.5 percent, 41,422 rooms)

- Upper Upscale (2.9 percent, 19,434 rooms)

- Midscale (2.5 percent, 10,870 rooms)

- Economy (0.9 percent, 6,206 rooms)

New York City led the major markets in rooms in construction as a percentage of existing supply.

- New York City (9.4 percent, 12,000 rooms)

- Phoenix (6.6 percent, 4,558 rooms)

- Nashville (5.6 percent, 3,181 rooms)

- Detroit (5 percent, 2,343 rooms)

- Miami (4.8 percent, 3,106 rooms)

“Limited-service continues to lead the national pipeline based on room count, but when you look at the numbers by percentage of existing rooms, it’s luxury hotels at the forefront,” said Hoyt. “That trend, however, does not correlate across the board when looking at individual markets. New York City, for example, shows in-construction economy hotels holding the highest percentage of existing supply at 37.2 percent. The market has been quite a comeback story over the last few months, achieving high levels in revenue per available room compared with other markets, thus remaining an attractive option to developers.”

Lodging Econometrics in August found that the U.S. topped the global hotel construction pipeline with 5,220 projects containing 621,268 rooms in the first six months of 2022.