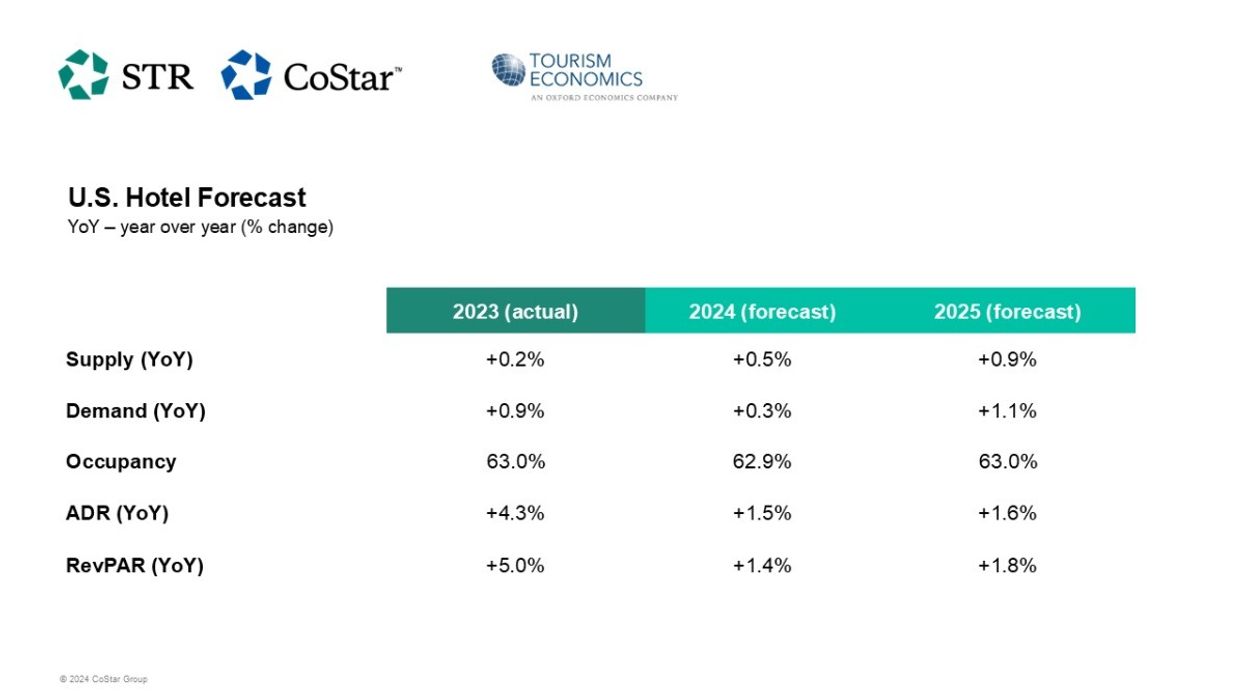

STR AND TOURISM Economics downgraded their growth rate forecast for the U.S. hotel business with their final revision of 2024. The forecast for next year remains uncertain as the impact of the presidential election becomes clear.

For 2024, projected gains in ADR and RevPAR were each downgraded, down 0.5 percentage points to 1.5 percent growth for ADR and with RevPAR’s projected growth dropping 0.6 ppts to 1.4 percent, respectively. Occupancy for the year was lowered 0.1 ppts to 62.9 percent, after the previous forecast projected the metric to remain steady from 2023. For 2025, the occupancy growth projection was downgraded 0.4 ppts, and the forecast for ADR and RevPAR increases were lowered to 1.6 percent and 1.8 percent, respectively.

“The outlook for 2025 remains somewhat in flux, with positive sentiment potentially offset by the higher cost of living,” said Amanda Hite, STR president. “Based on current economic conditions, higher-end hotels will continue to drive industry performance. The change in the presidential administration is anticipated to yield stronger economic conditions at first, which is not yet reflected in the data.”

Hite said annual GOP and EBITDA margins remain the same as the previous forecast and both are expected to improve slightly year over year. Lower labor costs are expected to drive higher growth for both metrics in 2025, she said, with inflation-adjusted GOP forecasted to inch closer to 2019 levels.

“Looking ahead to next year, the economic drivers are supportive of growth in travel activity. Consumer spending and business investment are expected to expand, helping support additional gains in business and group travel demand. Growth in international visitation also represents a tailwind for 2025,” said Aran Ryan, director of industry studies at Tourism Economics. “The forecast was prepared pre-election and assumed economic conditions consistent with political status quo. There is the potential that the Trump administration will pursue looser fiscal policy and provide a temporary boost to the economy, before offsetting effects such as tariffs and immigration act to moderately slow growth.”