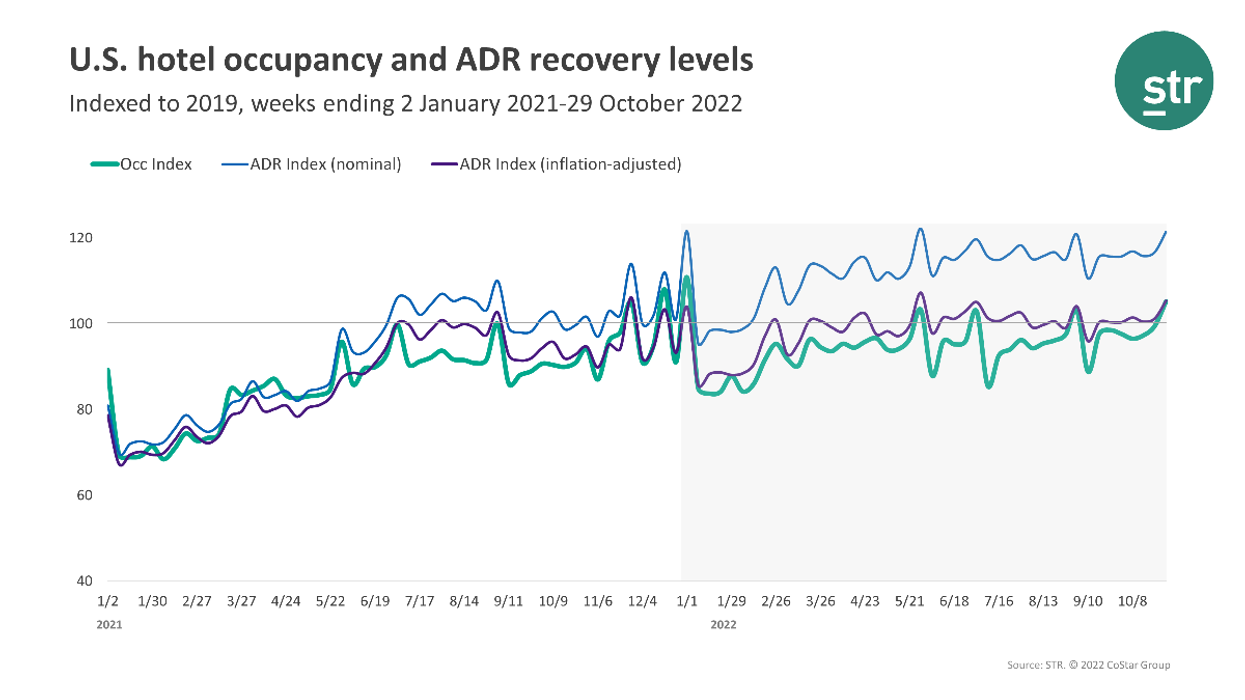

U.S. HOTEL PERFORMANCE dropped in the fourth week of October compared to the week before, according to STR. When compared to 2019, occupancy increased as a result of the Halloween calendar shift, as the holiday fell during the comparable week three years ago. STR reminded that in the first week of November performance metrics will show the negative side of that shift.

Occupancy was 65.8 percent for the week ending Oct. 29, down from 69.9 percent the week before and up 5.2 percent from 2019. ADR was $152.94 during the week, dipped from $157.43 the week before and up 21.4 percent from three years ago. RevPAR reached $100.59 during the week, down from $110.11 the week before and up 27.8 percent from 2019.

Among STR’s top 25 markets, Tampa reported the largest increase in each of the key performance metrics: occupancy up 21.5 percent to 76.1 percent, ADR increased 42.1 percent to $158.38 and RevPAR improved 72.5 percent to $120.58, over 2019. Tampa has been one of the markets in Florida that have seen a performance lift associated with post-Hurricane Ian demand.

San Francisco was the only market to post declines in ADR, down 7.4 percent to $218.81 and RevPAR, dropped 23.9 percent to $145.37.