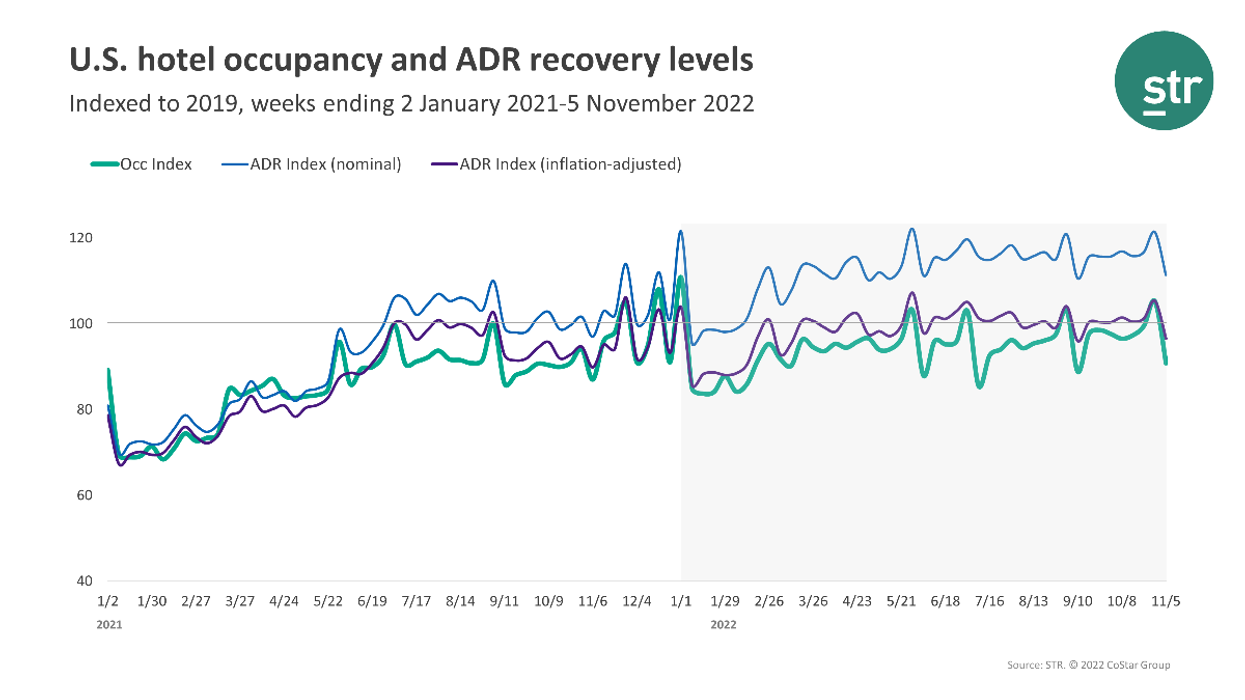

U.S. HOTEL PERFORMANCE dropped in the first week of November compared to the week before as expected due to the Halloween calendar shift, according to STR. Performance also weakened when compared to 2019.

Occupancy was 62.4 for the week ending Nov. 5, down from 65.8 percent the week before and dropped 9.2 percent from 2019. ADR was $147.48 during the week, decreased from $152.94 the week before and up 11.4 percent from three years ago. RevPAR reached $91.99 during the first week of November, down from $100.59 the week before and a slight increase of 1.1 percent from 2019.

None of STR’s top 25 markets showed an occupancy increase over 2019 during the week after Halloween. Tampa came closest to its pre-pandemic comparable, with an increase of 1 percent to 72.4 percent.

Miami posted the largest ADR increase, up 37.9 percent to $249.69, over 2019. The steepest RevPAR declines were in San Francisco, dropped 32.8 percent to $143.60, followed by Washington, D.C., dipped 23.3 percent to $110.09, over 2019.