EXTENDED-STAY HOTELS in June mirrored the April and May trend, where the economy segment saw a RevPAR decrease, while upscale extended-stay hotels achieve substantial growth, according to The Highland Group. The segment also finished the first half of 2023 on mixed results as occupancy dropped to a 13-year low while ADR and RevPAR increased faster than the overall hotel industry.

Summer travel season provides mixed results in June

Extended-stay hotels followed a pattern similar to that of April and May, with the economy segment experiencing a RevPAR decline, while upscale extended-stay hotels saw substantial RevPAR growth in June, according to Highland Group. Overall, extended-stay hotel segments consistently surpassed their counterparts in the wider hotel industry.

“Following two previous months in which extended-stay hotels achieved better performance than corresponding classes of all hotels, the onset of the summer travel season produced varying results in June,” said Mark Skinner, partner at The Highland Group. “Economy extended-stay hotels continued to report declining demand compared to a year ago but the decline was far less than for all economy class hotels. RevPAR growth for all hotels exceeded the extended-stay hotel gain but this was due to a smaller decline in occupancy as extended-stay hotels continued to report relatively strong growth in ADR. As expected, the summer travel season delivered greater revenue growth for higher priced extended-stay hotels.”

During the month, extended-stay hotel occupancy outpaced the overall hotel industry by 9.5 percentage points, a customary trend during the summer season. The variation in occupancy among extended-stay hotel segments mirrors the typical summer travel season, which often elevates occupancy rates at higher-priced extended-stay hotels, Highland said.

June marked the 10th consecutive month where the upscale segment registered the most substantial monthly increase in extended-stay hotel ADR. This also signifies the 20th straight month in which the total extended-stay ADR surpassed its nominal value in 2019.

The ADR growth observed in June also surpasses the 2.3 percent gain reported by STR for the overall hotel industry, aligns with the rate of increase seen between mid-2012 and the same period in 2014, it further said.

Since June 2022, the upscale segment consistently achieved the highest RevPAR gains each month.

“RevPAR growth for mid-price extended-stay hotels lagged behind the equivalent category for all hotels, while the economy segment experienced a 2.7 percent decline, aligning with the contraction reported by STR for all economy segment hotels,” the report said.

Meanwhile, extended-stay hotels outperformed the broader industry in May, demonstrating excellence across all segments. Despite the economy segment's RevPAR decline, upscale extended-stay hotels led with the highest increase, surpassing all other segments for June.

June witnessed the smallest monthly growth in total extended-stay hotel revenue in over two years. However, this increase surpassed the 2.8 percent gain reported by STR for all hotels during the same period, the report added.

In June, demand rose in the mid-price and upscale segments. “The economy segment saw its fifteenth consecutive monthly decline in demand, yet this contraction was the smallest in over a year and significantly less than the 4.4 percent decrease reported by STR for all economy hotels.”

The month also saw a 1.7 percent net rise in extended-stay room supply, aligning with the 12-month average. This marked the twenty-first month of modest 4 percent or less supply growth, notably below the long-term average. However, the economy segment recorded its most robust monthly supply gain in over two years, the report said.

Monthly supply comparisons, particularly in the upscale segment, continue to be influenced by re-branding that involves shifting rooms between segments in our database, the removal of hotels no longer meeting brand standards, and the sale of properties to multi-family apartment firms and municipalities, the June report said.

“While this effect is expected to diminish by the end of 2023, the overall yearly supply rise compared to 2022 is anticipated to remain significantly lower than the long-term average,” the report said.

Overall hotel industry catching up in first half of 2023

Highland Group’s mid-year report found that the overall hotel industry continued to catch up to extended-stay’s performance, even though it remained behind somewhat. RevPAR for the segment rose 3.2 percent during the second quarter of the year, the smallest quarterly increase in more than three years that was nevertheless better than the 2.7 percent increase reported for the overall hotel industry.

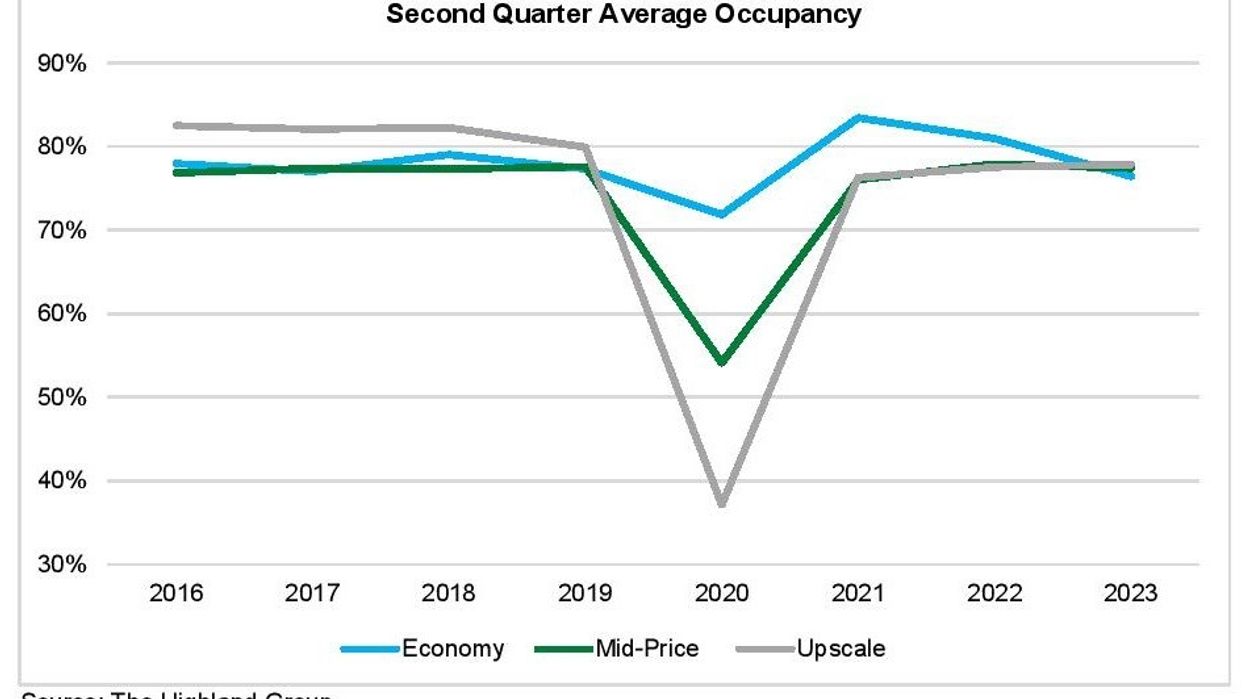

Extended-stay’s RevPAR recovery index for the second quarter was 113 percent, two points ahead of the rest of the industry. While the segment’s rates continued to increase, occupancy was dropping. Economy and mid-price extended-stay hotel segments are outperforming corresponding classes of all hotels.

“Very low supply growth bodes well for extended-stay hotels but the biggest single factor impacting near term metrics is likely to be the performance of the overall hotel industry,” Skinner said.

Supply and demand

In the extended-stay pipeline, rooms under construction gained 3 percent over the last year, lower than the pre-pandemic period and recent annual extended-stay hotel supply growth is among the lowest ever recorded, according to the report. It was between 2010 and 2014 that the segment last saw supply growth at the current level, when increases stayed at 3 percent or lower for four years.

“Extended-stay supply growth has been 3 percent or lower for only five consecutive quarters, indicating several more are ahead,” the report said. “Coupled with a near nationwide stagnant residential market, which is not likely to be resolved during the near term, and the expected boost to demand from the massive infrastructure bill, the foreseeable outlook for extended-stay hotels remains very good. Much, however, will depend on the performance of the overall hotel industry.”

Extended-stay hotel highlights from the mid-year report are:

- Room revenues were up 9 percent year to date

- Economy segment occupancy fell to a 13-year low

- ADR growth was at a two-year low but above long-term average gain 11 percentage point occupancy premium compared to all hotels

- Rooms under construction was second lowest in nine years