THE REVPAR RECOVERY of U.S. extended-stay hotels remain unchanged in August compared to July, according to consulting firm The Highland Group. However, ADR growth for mid-price and upscale segments decreased for the fifth consecutive month but remained higher than any other period before 2021.

STR said that hotel occupancy gained 5.3 percent in August 2022 compared to same period last year, decreasing extended-stay hotel’s occupancy premium to 12.6 percentage points compared to more than 14 points in August 2021. But the premium remains well within its long-term average range.

Economy and mid-price extended-stay segments reported much faster ADR growth compared to corresponding segments during the month, according to the US Extended-Stay Hotels Bulletin: August 2022. The economy segment continued leading the RevPAR recovery compared to 2019, but demand declined 1.9 percent for the fifth consecutive month compared to August 2021 due to strong increases in ADR.

The report said that the 1.2 percent increase in extended-stay room supply in August is the fifth successive month supply growth was below 2 percent (excluding 2020) and the eleventh consecutive month of 4 percent or lower supply growth. The upscale segment reported only a fractional gain in supply compared to last year as some brands are disenfranchising hotels that no longer meet new brand standards.

August’s supply change indicated that extended-stay hotel supply increases should be well below pre-pandemic levels during the near term, the report added.

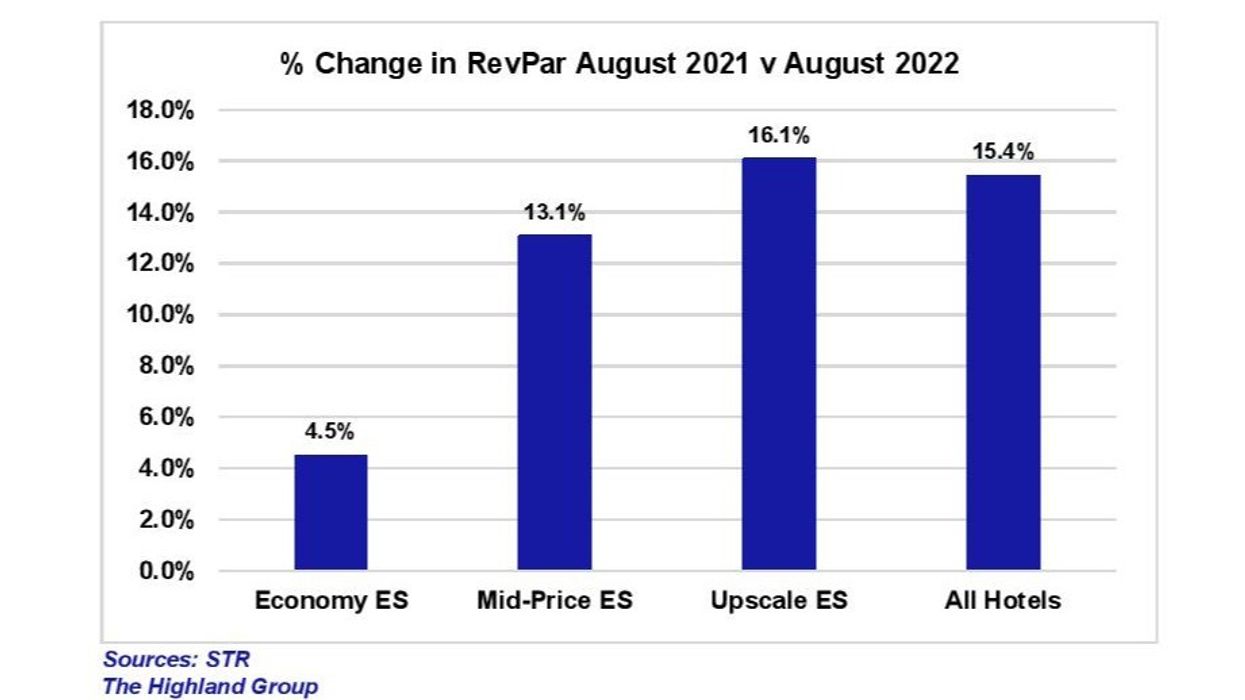

“Monthly revenue growth rates for the overall hotel industry and extended-stay hotels have narrowed since mid-year 2022 as the overall industry caught up from much larger revenue declines during the previous two years. The upscale extended-stay segment recorded the fastest revenue growth in August but it was below the 22.1 percent increase STR reported for all upscale class hotels. Revenue growth for economy and mid-price extended-stay hotels continues to be very strong compared to all economy and all mid-price hotel classes which STR reported gaining 0.9 percent and 5.7 percent respectively in August,” the Highland Group report said. “Mid-price and upscale extended-stay hotel demand rebounded in August as segment ADR increases moderated. The economy segment reported little change in ADR growth in August compared to July and demand contracted again. However, the decline was less than half the 4.4 percent fall STR reported for the overall class of economy hotels.”

Upscale extended-stay hotels reported the highest average occupancy at 97.9 percent of all extended-stay segments for the first time since December 2019 but remained below August 2019. It exceeded 100 percent this year only in April 2022.

“Mid-price and upscale extended-stay hotels continue to lead ADR growth but the gap between the economy extended-stay hotel’s ADR increase narrowed considerably in August for the tenth consecutive month. Mid-price and upscale segments continued posting the strongest RevPAR growth over the last year. However, only the mid-price segment reported a slight gain in its 2019 RevPAR in August compared to July,” the report added. “The RevPAR growth of overall hotel industry over the past year was greater than extended-stay hotels but the gap in August was less than two points, following an essentially negligible differential in July.”

The Highland Group earlier reported that the demand for U.S. extended-stay hotels dipped in July.