EXTENDED-STAY HOTELS OUTPEFORMED the broader hotel industry across all performance metrics in October, marking a notably strong month for the sector, according to The Highland Group. Extended-stay supply outpaced demand, leading to a decrease in occupancy. However, the decline was less pronounced than the overall hotel industry, where STR/CoStar reported a drop in demand compared to the previous year.

Furthermore, the metrics of extended-stay hotels, including ADR, RevPAR, and revenues, demonstrated stronger growth compared to their counterparts in the broader hotel industry, The Highland Group said. The 2.2 percent net rise in extended-stay room supply in October, consistent with September, represents a modest increase compared to the average over the past 16 months. However, October marked the 25th consecutive month of 4 percent or less supply growth, significantly below the long-term average.

The 12 percent surge in economy extended-stay supply, coupled with a reduction in mid-price segment rooms, primarily results from conversions, as new construction in the economy segment is estimated at around 2 percent of rooms compared to a year ago, the report added.

Supply change comparisons have been influenced by re-branding, room transfers between segments in The Highland Group's database, de-flagging of hotels not meeting brand standards, and the sale of properties to multi-family apartment companies and municipalities. This trend is expected to persist in 2023, given the recent emergence of relatively large portfolios of generally older extended-stay hotels on the market. However, the full-year increase in total extended-stay supply compared to 2022 will stay well below the long-term average.

In October, total extended-stay hotel revenue experienced the second-highest monthly increase in five months, surpassing the 2 percent gain reported by STR/CoStar for all hotels during the same period.

The economy segment recorded a demand increase exceeding 9 percent for the second consecutive month, primarily driven by a significant rise in supply from conversions, the report said. This increase also adversely affected demand changes in the mid-price segment. Total extended-stay demand saw growth, contrasting with STR/CoStar's estimate of a 1.2 percent decline for the overall hotel industry compared to October 2022.

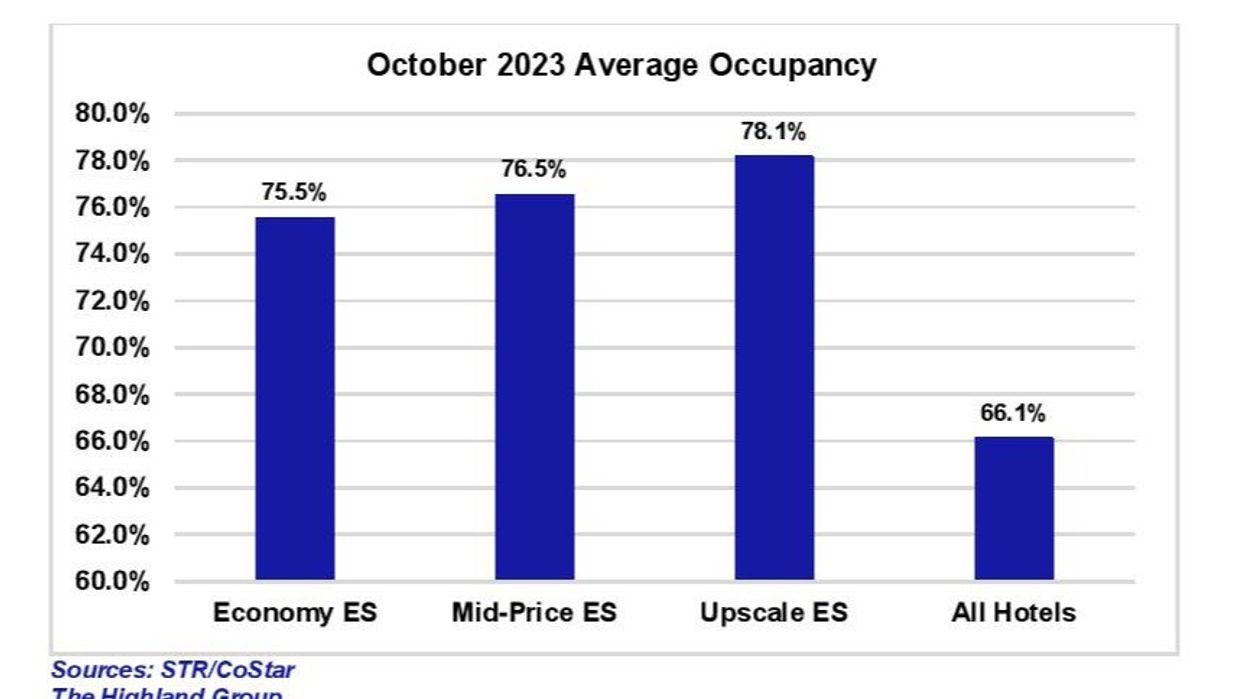

Meanwhile, extended-stay hotel occupancy surpassed the overall hotel industry by 10.9 percentage points in October, consistent with the historical long-term average.

October also witnessed the highest extended-stay ADR gain in five months, marking 24 consecutive months where total extended-stay ADR exceeded its nominal value in 2019. This October ADR growth, surpassing the 3.2 percent gain reported by STR/CoStar for the overall hotel industry, aligns with the rates of increase last observed during the mid-2017 to mid-2018 period.

Led by the mid-price and upscale segments, extended-stay RevPAR outperformed the overall hotel industry in October. Despite a continuous decline in RevPAR within the economy segment over the past seven months, October's decrease was lower than the year-to-date trend and significantly less than the 4.9 percent contraction reported by STR/CoStar for all economy segment hotels.

In September, extended-stay hotels outperformed the overall hotel industry. Despite extended-stay supply growing three times faster than all hotels, it still falls below the long-term average, according to The Highland Group. Additionally, the segment experienced a 1.9 percent increase in demand, whereas the overall hotel industry showed no growth.