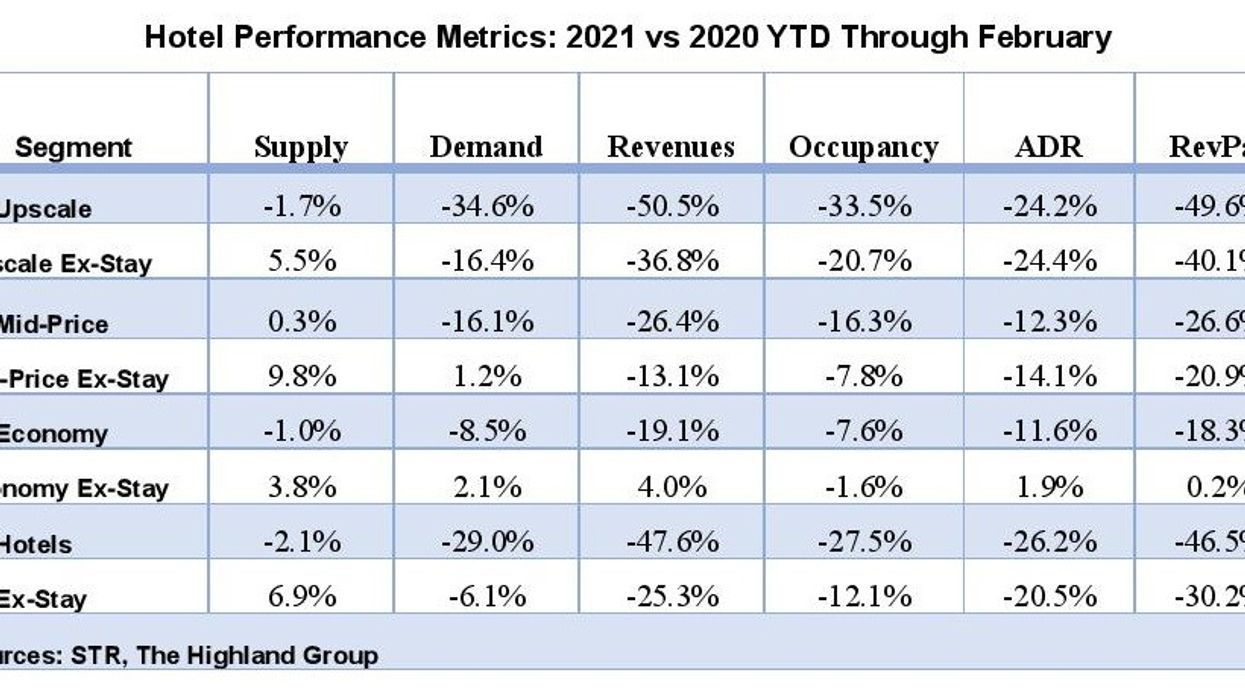

IN THE FIRST two months of 2021, extended-stay hotels continued to see the strongest performance among hotel segments, according to hotel investment advisors The Highland Group. With RevPAR indices moving up, extended-stay is leading the recovery, the firm said in a new report.

In January and February, extended-stay hotels on all rate scales saw much lower RevPAR losses compared to transient hotels of the same class, according to the Highland Group’s report “U.S. Extended-Stay Hotels: The COVID Recovery.” RevPAR indices for the year through February increased 24 percent to 39 percent above their 2017 to 2019 average. The indices were up 16 percent to 29 percent in 2020 compared to the average over the previous three years.

“Extended-stay hotel performance in January and February 2021 is even better than the headlines when you consider the same months in 2020 were pre-pandemic” said Mark Skinner, partner at The Highland Group.

All rate categories of the extended-stay segments saw a 12 to13 point occupancy premium over the all-hotel average and at 17.8 percentage points in 2020 it was the highest ever reported.

“The occupancy premium peaked at 23 percentage points in November 2020 and averaged 20 points for the second half of the year,” the report said. “The occupancy premium narrowed slightly in February 2021 but remained more than 19 percentage points higher than overall hotel average occupancy.”

As seen in previous reports, economy extended-stay hotels saw the strongest performance. Room revenue losses were kept in the single digits since two months after the beginning of the pandemic and by September the category was the first and only to see month-over-month revenue gains. The economy segment did see a slight decline in February after a strong performance in January.

“Economy extended-stay hotel’s relatively high components of essentially residential guests and construction industry related demand coupled with very little interaction between guests and hotel employees are key reasons the segment has performed better than any other hotel segment since the pandemic started,” the report said.

Economy and mid-price extended-stay hotels benefited from aggressive rate discounts in the second quarter of 2020 to minimize RevPAR losses. Meanwhile, up-scale extended-stay hotels saw RevPAR losses closer to the national average and also they did not reduce rates as much.

Other findings from the report include:

- Collectively, extended-stay room supply growth averaged 6.7 percent annually from 2016 through 2019 with growth beginning to peak in 2020.

- The economy segment posted month-on-month supply growth throughout 2020 but the rate of increase remains slightly below the 2.9 percent annual average from 2016 through 2019.

- Upscale extended-stay supply increases accelerated but remain significantly below the 7.4 percent annual average from 2016 through 2019.

- Economy extended-stay hotels incurred negligible closures in 2020 and was the only hotel industry segment to report positive change in room supply every month throughout the year.

“Like the broader hotel industry, extended-stay hotels have suffered the greatest revenue losses at higher price points,” the report said. “However, when compared to hotels of the same class, extended-stay hotels have performed much better.”