THE DEMAND PREMIUM that extended-stay hotels have experienced over the past two years compared to other types of hotels is beginning to ebb, according to consulting firm The Highland Group. Also, ADR growth decelerated for the fourth consecutive month in July but remains higher than any other period before 2021.

The overall hotel industry revenue recovery is now only one half a point greater than extended-stay hotels, according to the US Extended-Stay Hotels Bulletin: July 2022 report by the Highland Group. According to STR, all hotel room revenue was up 12.1 percent in July this year compared to last year.

“For the first time in more than two years all three extended-stay segments reported a monthly decline in demand compared to the previous year. Demand declines in economy and mid-price segments, which were less than corresponding falls for all hotels in the same rate categories, are mainly correlated to strong growth in ADR. The upscale segment’s demand decline is correlated to both increasing ADR and the contraction in supply,” the report said.

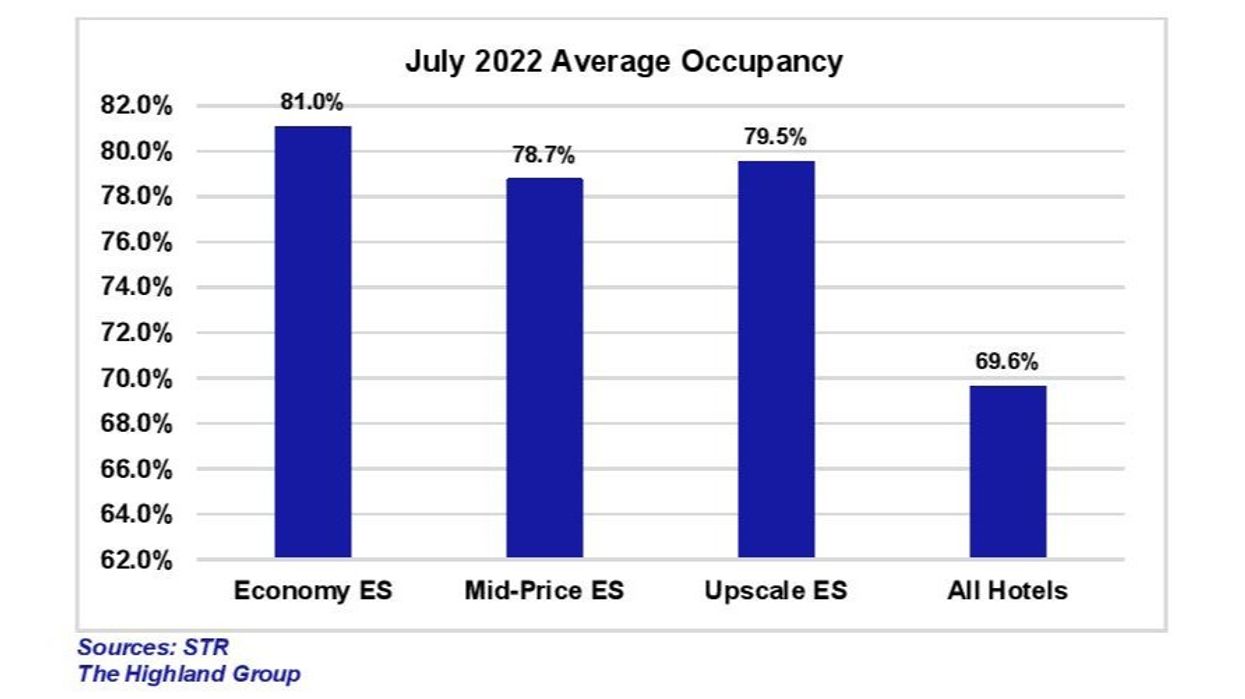

According to STR data cited in the Highland Group report, overall hotel occupancy gained 0.2 percent in July 2022 compared to 2021, decreasing extended-stay hotel’s occupancy premium to just under 10 percentage points. But it remains at the lower end of its long-term average range.

The RevPAR recovery of extended-stay hotels was up in July compared to June, according to the Highland Group. All extended-stay segments reported faster ADR growth during the month compared to other segments.

Economy extended-stay hotels led the RevPAR recovery in July compared to 2019, but demand declined 2.2 percent compared to the same period last year. This was the fourth consecutive month demand has declined, due to strong increases in ADR over several months, the report said.

There was a 1.2 percent increase in extended-stay room supply in July. This is the fourth successive month supply growth was below 2 percent (excluding some of 2020) and the tenth consecutive month of 4 percent or lower supply growth.

According to the report, the upscale segment reported a fractional decline in supply compared to July 2021, because of disenfranchising hotels by some brands. Some of these will remain as extended-stay hotels while others are being converted to apartments and some will be demolished, the Highland Group report added.

“Mid-price and upscale extended-stay hotels continue to lead ADR growth. The economy segment’s ADR recovery index contracted slightly in July compared to June but mid-price and upscale segments both gained about 2 percent over to 2019. For the fourth successive month, upscale extended-stay hotels more than fully regained ADR back to their nominal 2019 value,” the report pointed out. “Mid-price and upscale segments continued posting the strongest RevPAR growth over the last year. Both segments showed slight gains in 2019 RevPAR indices in July compared to June. Because the overall hotel industry lost far more RevPAR than extended-stay hotels in 2020, its RevPAR growth over the past year was greater but the gap in July was essentially negligible.”

A recent report by the Highland Group has said that the recovery gap between extended-stay hotels and other segments was close in the first half of 2022.