- Corporations led the Q4 meetings market, Knowland reported.

- Demand broadened YoY as technology, banking gained share.

- Government meetings declined to around 1.5 percent of total share.

CORPORATIONS CONTINUED TO lead the U.S. meetings market in the fourth quarter, according to Knowland. Demand broadened year over year as technology and finance/banking gained share and the overall mix became less concentrated.

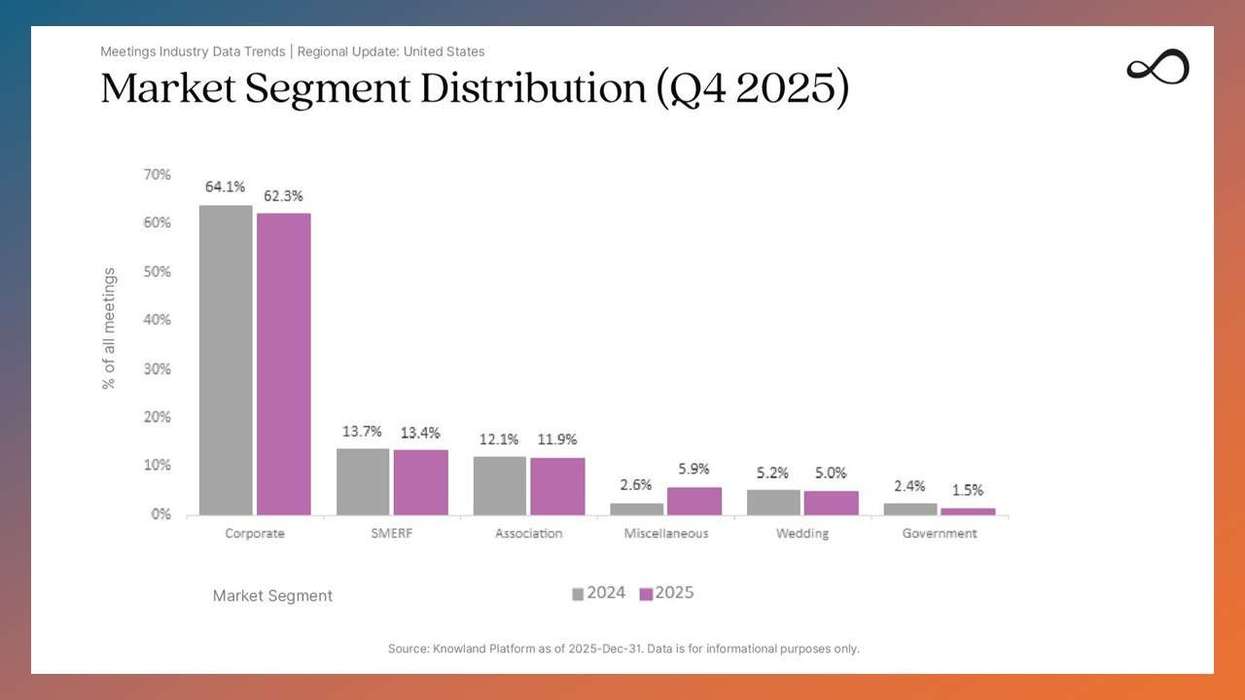

Knowland’s “Q4 2025 Meetings Industry Trends Regional Update: United States” showed corporate meetings accounted for about 62.3 percent of U.S. meeting activity in the quarter, down from approximately 64.1 percent a year earlier, indicating a rebalancing rather than a structural shift.

The change suggests organizations are diversifying meeting demand across segments, while corporate business continues to anchor the industry.

Other segments

Other segments were largely stable, the report said. The social, military, educational, religious, and fraternal groups or SMERF accounted for about 13.4 percent of activity, while associations held at roughly 11.9 percent. Government meetings declined to around 1.5 percent of total share.

By industry, charity, non-profit and social services remained the largest contributor to meeting volume despite a year-over-year dip, Knowland said. Technology held its position as the second-largest industry and gained share in the fourth quarter, while healthcare and consulting remained steady in third and fourth place.

Finance/banking, though still outside the top five, increased share year over year.

The ranking of leading industries changed little from the fourth quarter of 2024, indicating stable U.S. meetings demand, the report said. Share gains in technology and financial/banking were partially offset by declines in charity and non-profit segments.

Several industries showed year-over-year improvement, including aerospace, electronics, real estate, sports and entertainment and data and research services. Finance/banking and technology also ranked among the most improved categories.

Overall, fourth-quarter data shows a U.S. meetings market with stable demand. Corporate meetings continue to dominate, while gains in select industries are broadening the mix heading into 2026.

In May, the “Hospitality Group and Business Performance Index” by Cendyn and Amadeus reported a 109.1 percent year-over-year health rating for U.S. hospitality businesses in the first quarter of 2025, the highest in four quarters.