Manhattan’s Hotel Market Stabilizes with Strong RevPAR Growth in 2024

MANHATTAN’S HOTEL MARKET is stabilizing, with key metrics—occupancy, ADR, and RevPAR—showing strong growth in the second half of fiscal 2024, according to a PwC study. RevPAR rose 5.1 percent in the third quarter and 11.7 percent in the fourth quarter year over year.

PwC’s fourth quarter 2024 Manhattan Lodging Index found luxury hotels outperformed lower-priced counterparts across key metrics, highlighting a broader luxury resurgence.

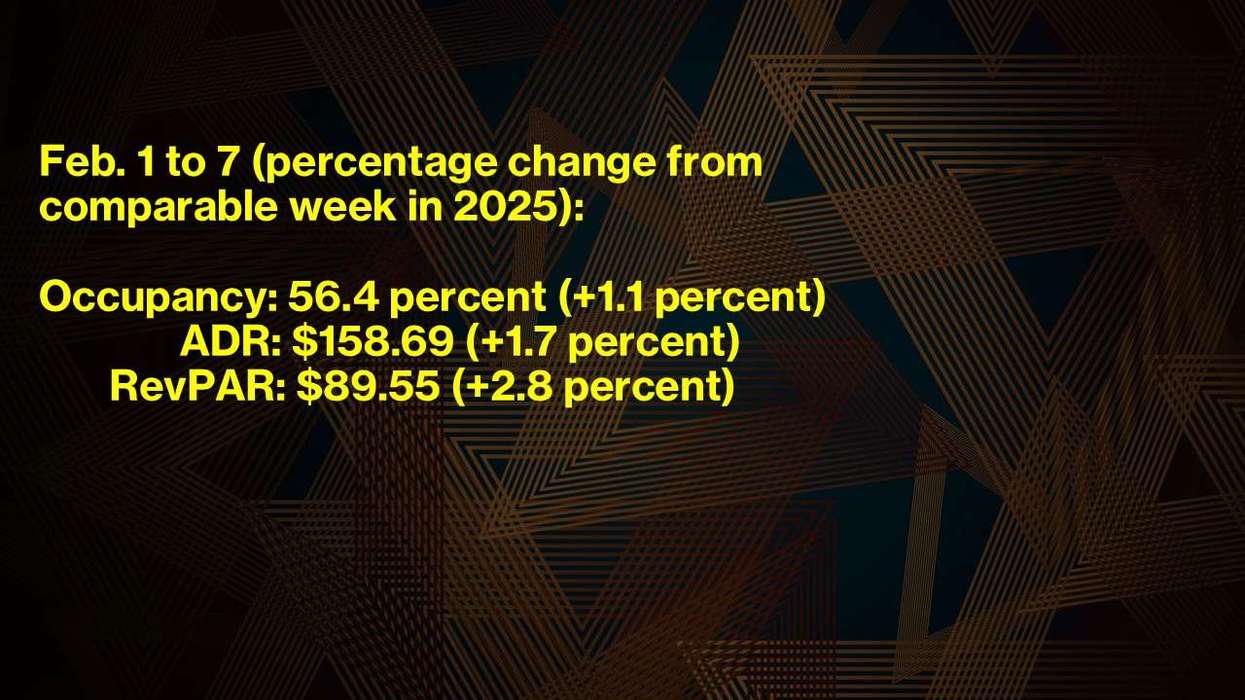

"As a bellwether market, Manhattan’s hotel market averaged an occupancy level of 89.3 percent in the fourth quarter of 2024, marking a return to pre-COVID stabilized levels,” said Abhishek Jain, PwC principal. “RevPAR growth was strong in the fourth quarter, recording the highest year-over-year growth of any quarter in 2024. However, with the anticipated stabilization of the market, along with several new openings projected, growth is expected to moderate in 2025."

Occupancy and ADR grew faster than in the third quarter, the report said. Year-over-year occupancy gains were highest in October, up 5.5 percent, and lowest in December, up 1.4 percent. Fourth-quarter occupancy averaged 89.3 percent, while ADR reached $420.74, pushing RevPAR from $336.30 in the fourth quarter of 2023 to $375.65 in the fourth quarter of 2024.

Luxury properties led RevPAR growth among the four market classes, rising 15.3 percent in the fourth quarter, PwC said occupancy increased from 80.4 percent to 84.3 percent, while ADR rose 9.9 percent from $639.89 to $703.55.

Upscale properties saw a 2.3 percent occupancy increase and a 6.5 percent ADR rise, pushing RevPAR up 9 percent from the fourth quarter of 2023. Upper upscale properties posted a 10.6 percent RevPAR gain, driven by a 3.8 percent occupancy increase and a 6.5 percent ADR rise. Upper-midscale properties saw a 10.8 percent RevPAR increase, driven by a 4.4 percent rise in occupancy and a 6.2 percent gain in ADR.

All four market classes recorded at least 5 percent RevPAR growth since the fourth quarter of 2023, supported by higher occupancy and ADR, the report said.

Meanwhile, Manhattan hotel transactions held steady in the second half of 2024, with Crowne Plaza Times Square selling for $334 million, the highest price, followed by Thompson Central Park at $307 million, PwC said. Leyad, a Canadian investment firm, acquired Ink48 Hotel for $62 million.

Manhattan's 2025 hotel openings include the 51-story, 379-room Hotel Meta, part of Marriott's Tribute Portfolio, and a 529-room Kimpton, both in Midtown, per PwC.

A recent Cloudbeds report urged independent hotel operators to refine strategies in 2025 to stay competitive amid labor shortages, price-sensitive travelers, and the growing dominance of branded hotels, now 72 percent of U.S. properties.