THE LOS ANGELES wildfires affected U.S. hotel performance in the second week of January, with a slight occupancy increase but declines in RevPAR and ADR, according to CoStar. The MLK Day shift, calendar changes for groups and conferences and winter storm Cora further weakened year-over-year growth across key metrics.

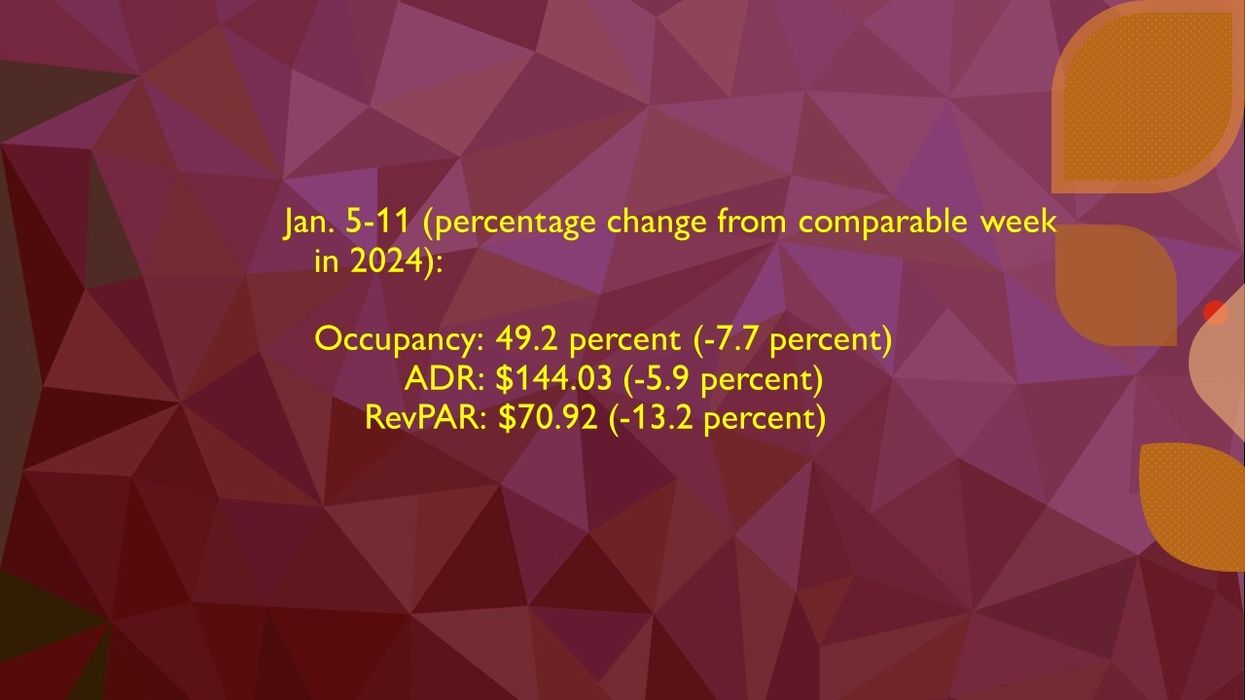

Occupancy rose to 49.2 percent for the week ending Jan. 11, up from 48.3 percent the previous week, but down 7.7 percent year-over-year. ADR fell to $144.03 from $168.90, a 5.9 percent year-over-year decline. RevPAR dropped to $70.92 from $81.53 the prior week, reflecting a 13.2 percent decrease compared to the same period in 2024.

Tampa led the top 25 markets in year-over-year growth, with occupancy rising 18.2 percent to 79.1 percent, ADR increasing 7.6 percent to $178.42, and RevPAR growing 27.2 percent to $141.20.

Meanwhile, Los Angeles saw the second-highest increases in occupancy, rising 5.7 percent to 65 percent, and RevPAR, growing 8.6 percent to $122.63, driven by displacement demand from the fires.

San Francisco saw the steepest RevPAR decline, falling 78.1 percent to $85.89, due to the J.P. Morgan Healthcare Conference calendar shift.