INDIA’S KAMAH HOTELS & Resorts recently signed a $70 million agreement with Wyndham Hotels & Resorts to develop four new hotels—three in India and one in the UAE—under the Trademark Collection by Wyndham. Kamah Hotels plans to add 25 more properties globally, including in North America, over the next three years.

Fine Acres Group will develop the Indian properties, while Global Branded Residences will build the Dubai project. Fine Acres, which operates in India, and international developer GBR previously created Kamah Hotels.

Kamah Hotels finalized locations for lifestyle resorts in Coorg, Karnataka; Jawai and Udaipur in Rajasthan; and Al Jaddaf Waterfront, Dubai, UAE, the statement said. The partnership marks the debut of the Trademark Collection by Wyndham in the UAE, the companies said in a statement.

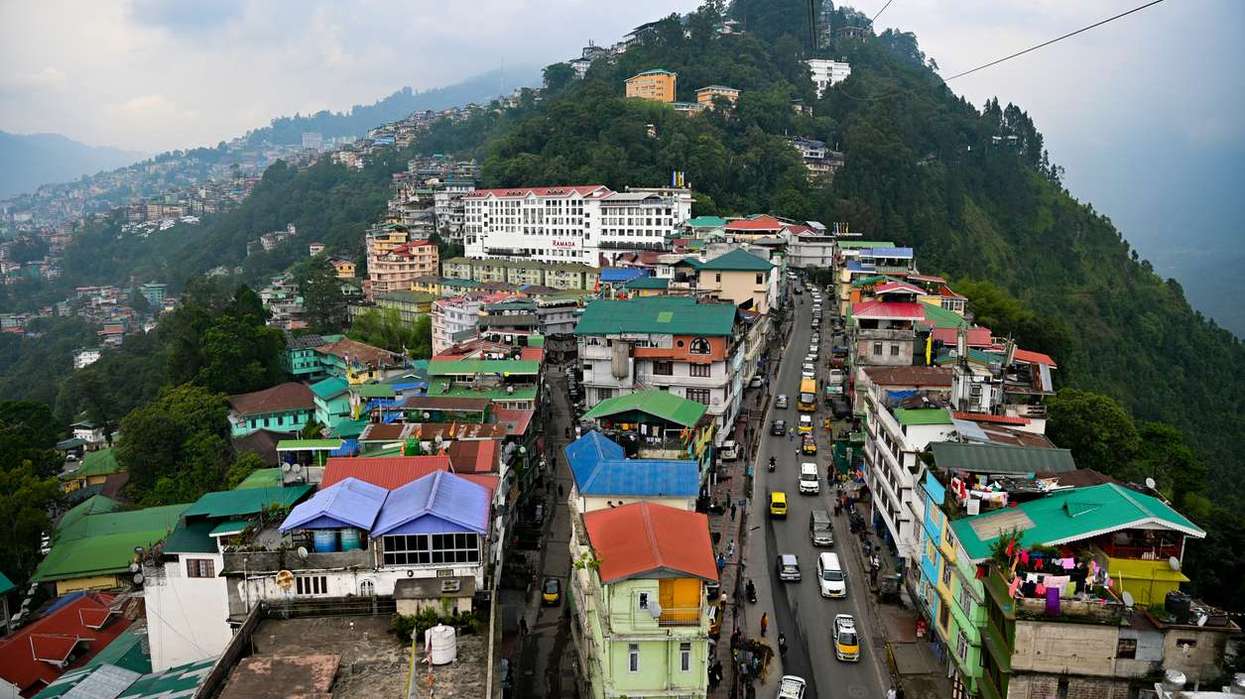

"After our successful collaboration with Wyndham Grand Jaipur last year, we are thrilled to further strengthen our partnership with Wyndham Hotels & Resorts,” said Dinesh Yadav, Fine Acers Group and Global Branded Residences’ managing director. "This partnership will see the launch of four hotels under the Kamah brand, offering an exclusive luxury and wellness experience under the Trademark Collection by Wyndham. The first set of properties will be located in Dubai, Coorg, Jawai and Udaipur with further expansions planned in global destinations across North America, Australia and Europe, as well as prominent leisure locations in the Indian subcontinent, such as Goa, Lonavala, and Dharamshala.”

The hotels will follow a branded residences model, allowing investors to purchase units in internationally branded resorts in prime leisure destinations. Imran Khan, CEO and founder of PIXL Group, is the exclusive global strategy and marketing partner for Kamah Hotels.

"We are delighted to extend our collaboration with Fine Acers Group and to introduce the Trademark Collection by Wyndham to the UAE market," said Govind Mundra, Wyndham’s head of development for the Middle East & Africa. "This partnership is just the beginning, with plans for many more properties to follow and building on the ‘Owners First’ policy of Wyndham.”

India and the UAE are growth markets for hospitality, driven by rising tourist arrivals. Dubai, a global trade and tourism hub, contributed 9 percent to the UAE’s GDP in 2022, with projections from the UAE Ministry of Economy that this will increase to 15 percent by 2031.

A recent HotStats report highlighted that rising wealth among India’s 1.5 billion people is fueling demand for hotel rooms across all asset classes, presenting both opportunities and challenges for developers and operators.