Summary:

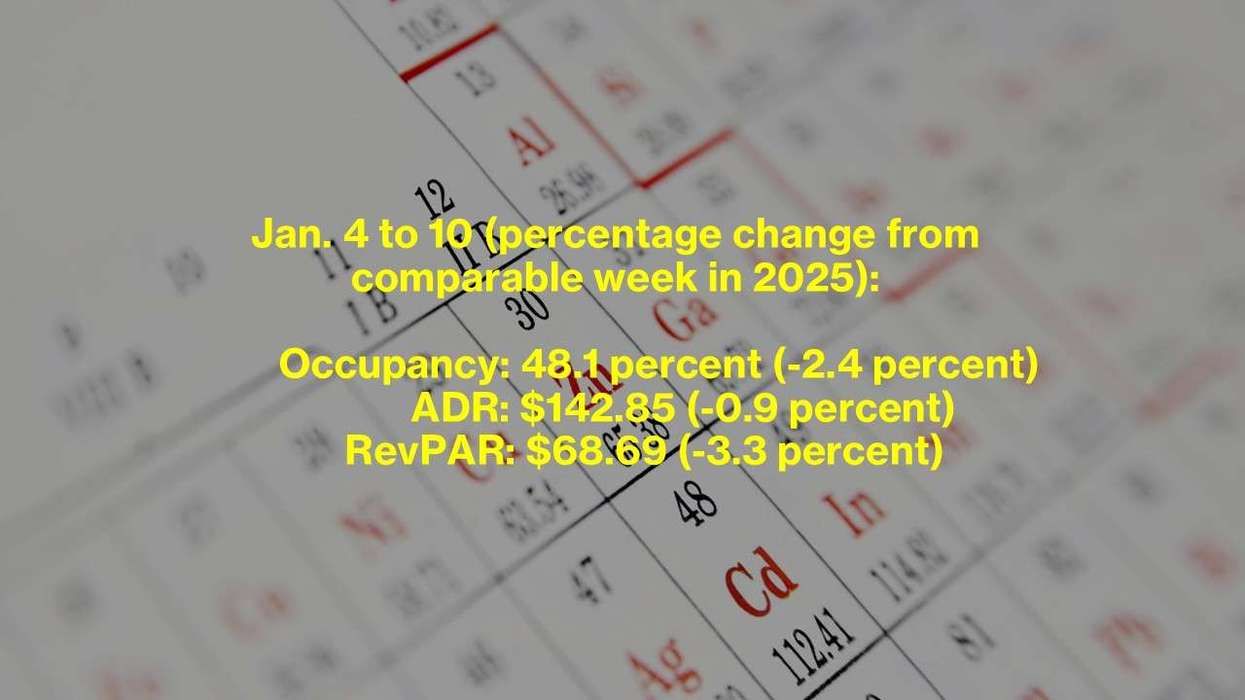

- Occupancy fell to 48.1 percent for the week ending Jan. 10.

- RevPAR declined in 16 of the top 25 markets.

- St. Louis posted the largest gains; Tampa and San Diego lead declines.

U.S. HOTEL METRICS declined in the second week of January, hitting weekly and yearly lows, according to CoStar. RevPAR fell in 16 of the top 25 markets.

Occupancy fell to 48.1 percent for the week ending Jan. 10, from 50.5 percent the prior week, 2.1 points below last year. ADR dropped to $142.85 from $175.47, down 0.9 percent year over year. RevPAR declined to $68.69 from $88.65, 3.3 percent below the same week in 2025.

Among the top 25 markets, Tampa led declines in all three metrics: occupancy fell 23.2 percent to 60.9 percent, ADR dropped 12 percent to $156.81 and RevPAR fell 32.4 percent to $95.44.

San Diego posted the second-largest declines: ADR fell 9.5 percent to $161.76 and RevPAR dropped 22.5 percent to $82.72.

St. Louis led gains in all metrics: occupancy rose 18.1 percent to 46.9 percent, ADR increased 14.2 percent to $117.19 and RevPAR rose 34.9 percent to $54.92, boosted by the U.S. Figure Skating Championships.