- Hyatt posted higher RevPAR in Q4 and full-year 2025, while net income declined.

- Luxury and upper-upscale hotels led RevPAR growth.

- The company opened 8,253 rooms in Q4, including Hyatt Studios Huntsville.

HYATT HOTELS CORP. reported higher RevPAR for the fourth quarter and full year of 2025, while net income fell. Comparable systemwide RevPAR rose 4 percent in the quarter and 2.9 percent for the year versus 2024.

RevPAR growth was highest in luxury and upper-upscale hotels, Hyatt said in a statement. Leisure transient demand led and group business benefited from Rosh Hashanah, which fell in the third quarter of 2025 versus the fourth quarter of 2024.

“We ended 2025 with strong execution against our strategic priorities and continued progress toward becoming a more brand-focused organization,” said Mark Hoplamazian, Hyatt’s president and CEO. “We achieved commercial and operating performance in 2025 and expanded our portfolio and network effect through disciplined transactions and organic growth.”

Room growth, pipeline expansion

Net rooms growth was 7.3 percent for the year, or 6.7 percent excluding acquisitions, the statement said. The pipeline of executed management and franchise contracts reached about 148,000 rooms, up 7 percent year on year. Hyatt ended 2025 with its highest U.S. room signings in five years, up 30 percent from 2024, half in new markets, driven by its five brands and a loyalty program of over 63 million members.

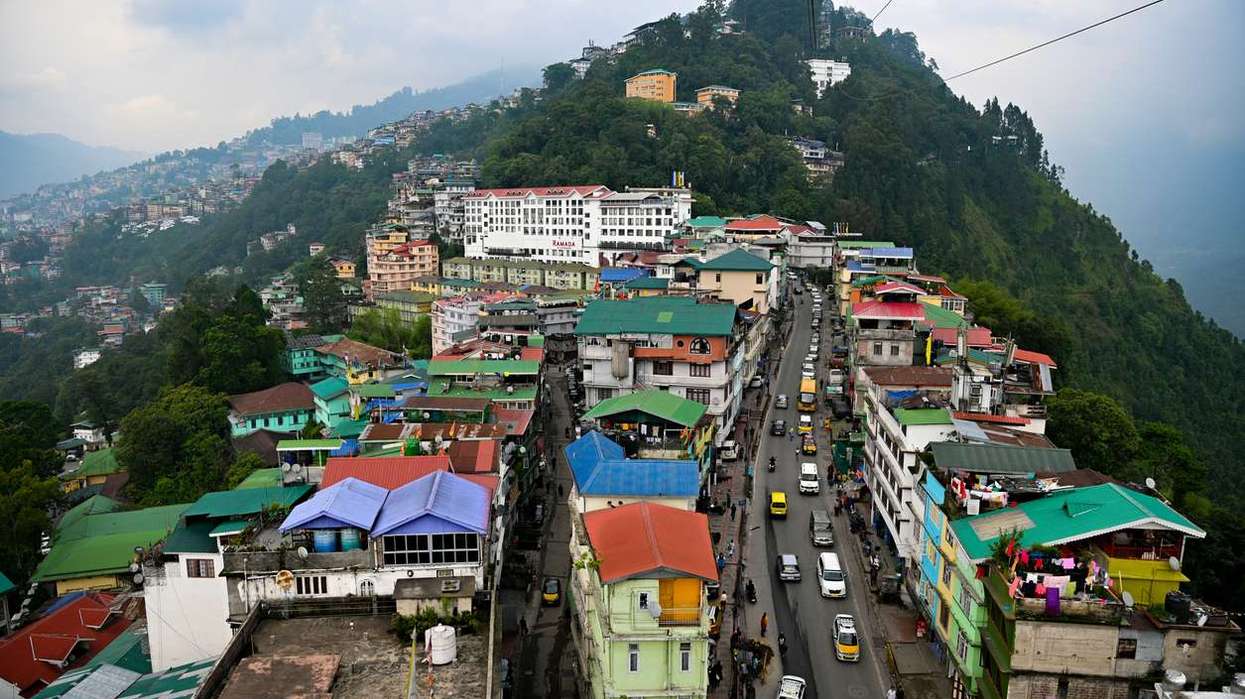

The company opened 8,253 rooms in the fourth quarter, including Park Hyatt Cabo del Sol, Andaz One Bangkok and Hyatt Studios Huntsville. The Hyatt Studios pipeline reached about 70 properties since its 2023 launch. Asia-Pacific pipeline activity increased 7 percent, with signings in Greater China and India.

Hyatt also completed the sale of the Alua portfolio for about $140 million and entered long-term management agreements for each property. Proceeds were used to repay part of the $1.7 billion delayed draw term loan from the Playa Hotels acquisition. It completed the Playa real estate transaction, entered 50-year management agreements for 13 of 14 properties and repaid the remaining term loan balance.

In September, Hyatt also marked the 45th anniversary of its Park Hyatt brand, launched in 1980 with Park Hyatt Chicago, and introduced “Luxury Is Personal,” its first global marketing campaign for the brand in over five years.

Q4 earnings and financials

Net loss attributable to Hyatt was $20 million in the fourth quarter and -$52 million for the year, the data showed. Adjusted net income was $126 million in the fourth quarter and $209 million for the year. Diluted EPS was -$0.21 in the quarter and -$0.55 for the year and adjusted diluted EPS was $1.33 and $2.19, respectively.

Gross fees totaled $307 million in the fourth quarter, up 4.5 percent year on year and $1,198 million for the year, up 9 percent. Adjusted EBITDA was $292 million in the fourth quarter, up 14.6 percent year on year or 3.8 percent after adjusting for assets sold in 2024 and the Playa Hotels acquisition. Full-year adjusted EBITDA was $1,159 million, up 5.8 percent, or 7.4 percent on an adjusted basis.

Base management fees increased 8.1 percent, supported by newly opened hotels and managed hotel RevPAR growth outside the U.S., Hyatt said. Incentive management fees rose 13 percent, driven by new openings, Asia-Pacific performance and all-inclusive properties in Europe. Franchise and other fees declined 3.8 percent due to the removal of franchise fees from eight Hyatt Ziva and Hyatt Zilara properties acquired in the Playa Hotels deal and lower demand at select-service properties in the U.S.

Owned and leased segment adjusted EBITDA fell 1.5 percent year on year after adjusting for asset sales and acquisition timing, due to renovations at some properties. Distribution segment adjusted EBITDA declined due to Hurricane Melissa and lower booking volumes at four-star and lower properties.

In the first quarter of 2026, Hyatt revised its definition of adjusted EBITDA to exclude its pro rata share of unconsolidated owned and leased hospitality ventures.

2026 Outlook

For 2026, Hyatt expects systemwide RevPAR growth of 1 percent to 3 percent. Net rooms growth is projected at 6 percent to 7 percent. Net income is forecast between $235 million and $320 million. Adjusted EBITDA is projected between $1.155 billion and $1.205 billion under the revised definition.

“As we look to the future, we are focused on advancing our brands, talent and technology,” Hoplamazian said. “These priorities will position Hyatt to become the most responsive, innovative and best-performing hospitality company and the most chosen by our stakeholders.”

Separately, Hilton Worldwide Holdings reported net income of $298 million in the fourth quarter and $1.461 billion for the year. Marriott International’s worldwide RevPAR rose 1.9 percent in the fourth quarter and 2 percent for 2025.