HYATT HOTELS CORPORATION plans to expand its brand portfolio in India and Southwest Asia, with eight new hotels set to open across various leisure and city destinations in 2024. The expansion will focus on Hyatt Regency, Hyatt Place and Hyatt Centric brands and is timed to coincide with an expected rebound of travel in the country and sub-continent, Hyatt said in a statement.

“Southwest Asia continues to demonstrate high growth potential and is among the top global growth markets for Hyatt, said Sunjae Sharma, Hyatt’s managing director for India and Southwest Asia. “We have strong expansion plans for 2024 across our portfolio encompassing our legacy brands like Hyatt Regency, Hyatt Place and Hyatt Centric across destinations that will strengthen our brand presence in key markets. This expansion represents our strong commitment and confidence in the Southwest Asia region.”

Hyatt is also expanding its luxury and lifestyle brands in India, including the recent launch of JdV by Hyatt with the opening of Ronil Goa, the statement said. JdV by Hyatt is the ninth brand introduced by Hyatt in India, reaffirming its commitment to expanding its presence in the country.

“Complementing our current portfolio of Hyatt brands in the country, the introduction of the JdV by Hyatt lifestyle brand in India signifies a strategic milestone in Hyatt's thoughtful expansion within the leisure and business segments,” Sharma said. “We are excited for our guests travelling to Goa to embrace this lifestyle experience. Ronil Goa aligns seamlessly with the brand that encourages living in the moment, making it a perfect addition. We look forward to further enhancing our distinctive brand footprint throughout the sub-continent.”

India pipeline

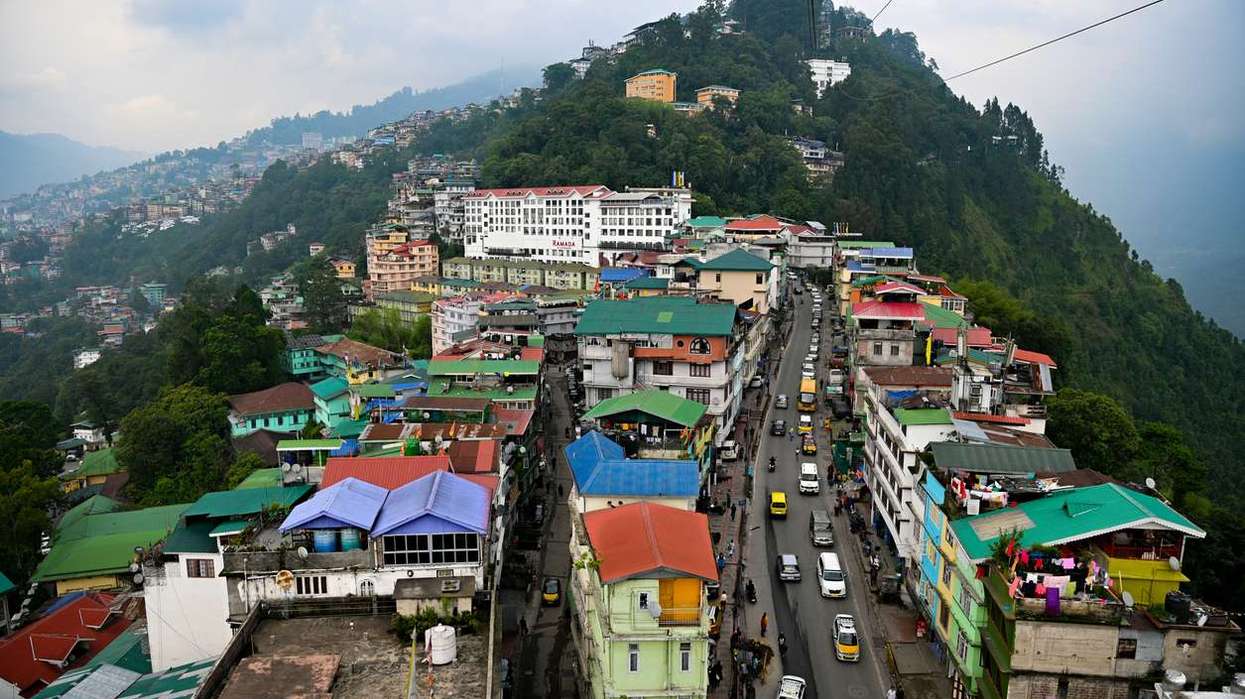

Hyatt Regency will debut in new destinations with openings in Kasauli and Ghaziabad, the company said. Hyatt Place is set to expand into three new locations: Aurangabad and Haridwar in the region, and Dhaka, Bangladesh, marking its entry into a new country. The Hyatt Centric brand will also grow its portfolio with anticipated openings in Hebbal, Bengaluru and Ballygunge, Kolkata.

In 2023, Hyatt extended its brand presence in India with the inauguration of Hyatt Place Bodh Gaya, Hyatt Place Vijaywada, Hyatt Place Goa Candolim, and Hyatt Centric Rajpur Road Dehradun, it said. This expansion across leisure, corporate, and spiritual tourism segments has strengthened Hyatt's position in India and the Southwest Asian region.

With these new additions, Hyatt's India and Southwest Asia portfolio will include nine distinct brands: Andaz, Alila, Park Hyatt, Grand Hyatt, Hyatt Regency, Hyatt, Hyatt Centric, Hyatt Place and JdV by Hyatt.

In February, Hyatt reported $26 million in net income for Q4 2023 and $220 million for the year, fueled by group demand recovery and rate growth across both group and transient customers.