How Did U.S. Hotel Metrics Perform in March 2025?

U.S. HOTEL METRICS improved for the week ending March 21, showing both weekly and yearly gains, according to CoStar. Anaheim led the top 25 markets in year-over-year occupancy growth.

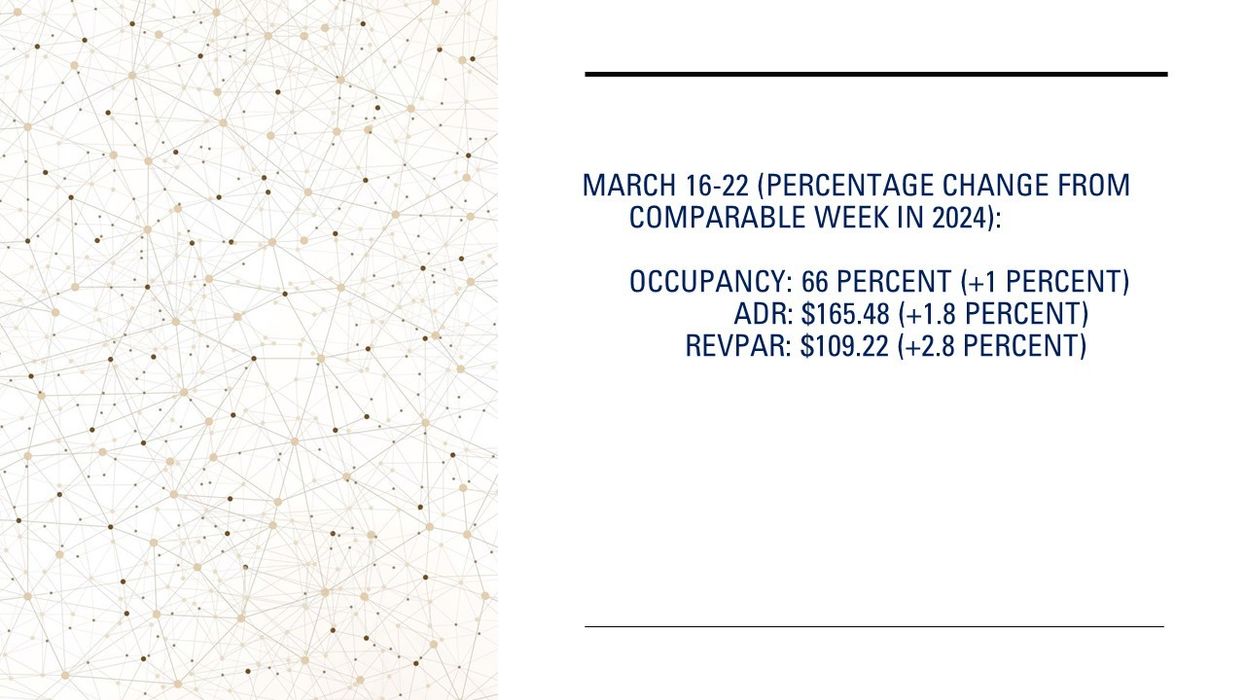

Occupancy increased to 66 percent for the week ending March 22, up from 64.2 percent the previous week and 1 percent higher than the same period last year. ADR rose to $165.48 from $162.49 the prior week, marking a 1.8 percent year-over-year gain. RevPAR increased to $109.22 from $104.36, representing a 2.8 percent improvement over the previous year.

Among the top 25 markets, Anaheim had the highest occupancy growth, up 15.5 percent to 83.8 percent. Chicago recorded the largest ADR gain, up 17.8 percent to $164.41, and the biggest RevPAR increase, up 21.8 percent to $107.71.

Washington, D.C., saw the steepest RevPAR decline, down 17.8 percent to $133.35, followed by Denver, which fell 14.5 percent to $80.