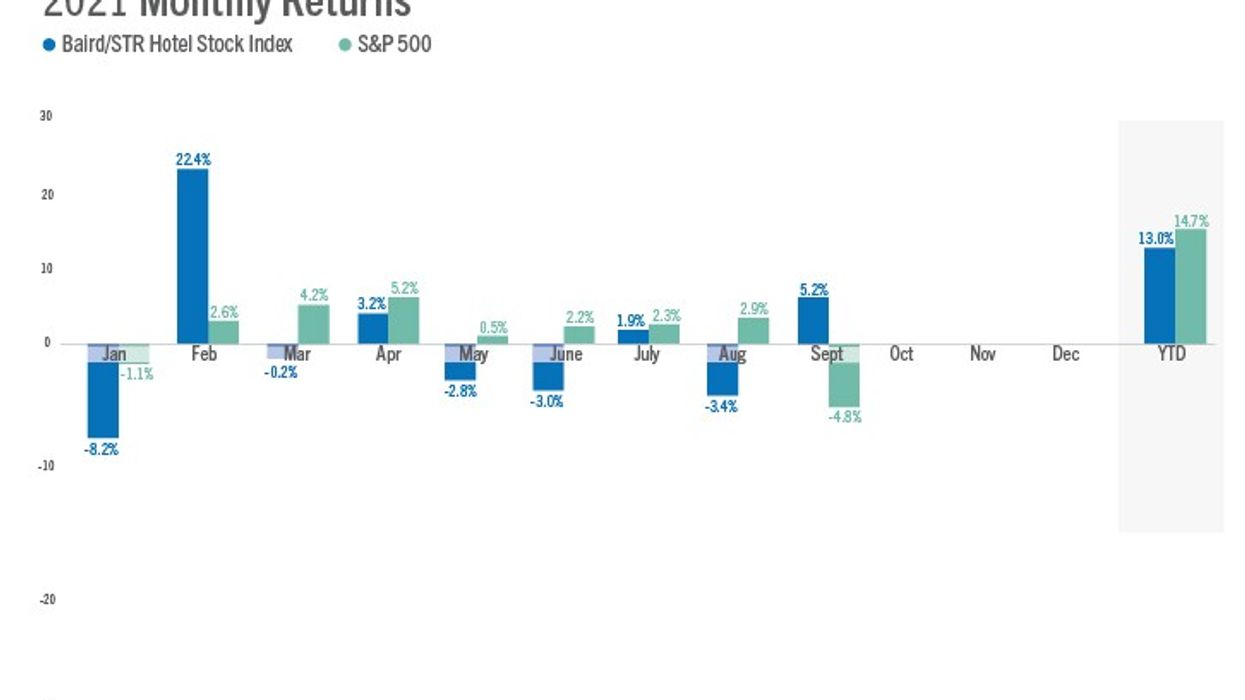

HOTEL STOCKS ROSE in September based on higher-than-expected group travel business, according to the Baird/STR Hotel Stock Index. The index rose 5.2 percent during the month compared to August.

Also, the index was up 13 percent year-to-date for the first nine months of 2021. The Baird/STR index for September surpassed the S&P 500, which fell 4.8 percent from the prior month, and the MSCI US REIT Index, which dropped 6 percent. The hotel brand sub-index rose 6.7 percent from August, while the Hotel REIT sub-index increased 1 percent.

“Hotel stocks rebounded strongly in September and finally broke their streak of six consecutive months of relative underperformance,” said Michael Bellisario, senior hotel research analyst and director at Baird. “Delta variant concerns mostly subsided during the month, and hotel stocks benefited from higher interest rates and the broader market rotation that lifted all travel-related stocks.”

The month saw some unexpected, good news, said Amanda Hite, STR president.

“The post-Labor Day period had been a source of consternation for the industry, but the early returns produced a pleasant surprise with group demand above 1 million for two consecutive weeks,” she said. “We did see a performance dip late in the month, but ups and downs are expected at this point in the recovery cycle. Overall, we estimate September demand at 93 percent of the 2019 comparable, and there were noticeable improvements in the major markets and corporate-dependent hotels. With leisure demand continuing to deliver, but business travel and groups progressing much slower, we do not expect recovery to kick into the next gear until next year.”