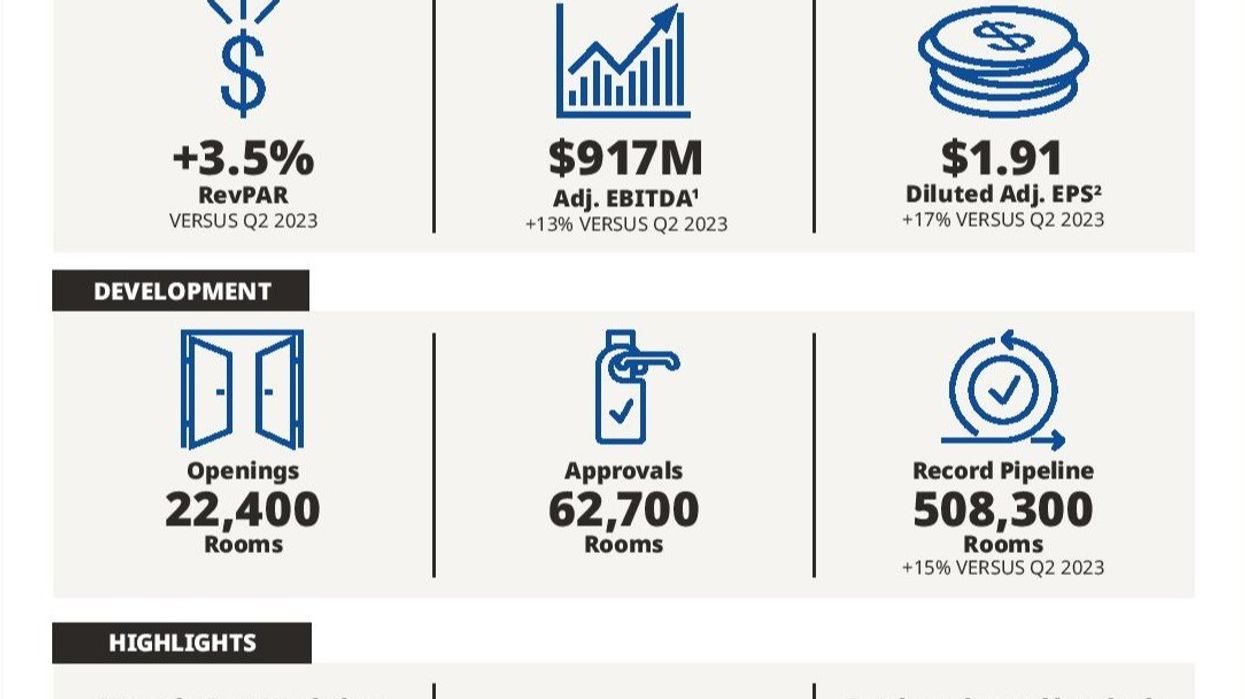

HILTON WORLDWIDE HOLDINGS reported net income of $422 million for the second quarter ending June 30, up from $413 million last year. The development pipeline grew 15 percent year-over-year to 3,870 hotels with 508,300 rooms, an 8 percent increase from the previous quarter. Systemwide RevPAR rose 3.5 percent year-over-year due to higher occupancy and ADR.

"We are pleased to report a solid second quarter, with an increase in RevPAR of 3.5 percent, driven by growth in all segments, with particularly strong group performance,” said Christopher Nassetta, Hilton’s president and CEO. “On the development side, we ended the quarter with a record development pipeline, up 15 percent from the prior year and up 8 percent sequentially from the first quarter, including strategic partner hotels. Looking forward to the rest of the year, with the continued growth of our existing brands, as well as the addition of our new brands and strategic partner hotels, we expect net unit growth of 7 percent to 7.5 percent for the full year."

Adjusted EBITDA for the three months ended June 30 was $917 million, up from $811 million in 2023, Hilton said. Management and franchise fee revenues increased by 10 percent year-over-year. In the US, second-quarter occupancy rose by 1.1 percentage points to 76.8 percent, ADR increased by 1.4 percent to $172.36, and RevPAR climbed 2.9 percent to $132.33.

Hilton opened 165 hotels with 22,400 rooms in the second quarter, adding 18,000 net rooms for 6.2 percent net unit growth. The company expanded its lifestyle portfolio by acquiring the Graduate brand, adding 32 hotels and four more in the pipeline. In July, Hilton partnered with Small Luxury Hotels of the World, adding 400 SLH hotels to its system. The NoMad London, the first NoMad hotel, also joined Hilton’s portfolio, and 27 Spark hotels opened, more than doubling the brand’s supply.

Hilton added 62,700 rooms to its development pipeline during the second quarter. As of June 30, the pipeline included 3,870 hotels with 508,300 rooms, up 15 percent year-over-year and 8 percent from the prior quarter. These hotels are in 136 countries and territories, including 39 with no previous Hilton presence, with 251,800 rooms under construction and 298,800 rooms outside the US. Hilton’s global hotel count surpassed 8,000 in July.

For 2024, Hilton projects a 2 percent to 3 percent increase in systemwide comparable RevPAR (currency-neutral) compared to 2023. Net income is expected between $1.53 billion and $1.55 billion, with adjusted EBITDA projected at $3.37 billion to $3.40 billion. Contract acquisition costs and capital expenditures, excluding reimbursements, are estimated at $250 million to $300 million.

Hilton forecasted a 2 percent to 3 percent increase in systemwide comparable RevPAR (currency-neutral) during the third quarter. Net income is projected to be between $435 million and $448 million, with adjusted EBITDA ranging from $875 million to $890 million.

In June, Hilton announced plans to double its 350 lifestyle hotels by 2028, adding 350 more within four years, including 100 this year. The company also appointed Kevin Osterhaus as president of global lifestyle brands to oversee growth, design, and development.