What's the latest on US extended-stay hotel performance for April 2025?

U.S. EXTENDED-STAY AND overall hotel RevPAR declined in April, reflecting their long-term correlation, according to The Highland Group. Economy and mid-price extended-stay hotels performed better than their respective classes, while upscale extended-stay hotel RevPAR fell in line with all upscale hotels, according to STR/CoStar.

The Highland Group’s “US Extended-Stay Hotels Bulletin: April 2025” reported a 3.6 percent year-over-year increase in extended-stay room nights available. This gain partly reflects the addition of mid-price brands WaterWalk by Wyndham in May 2024 and Executive Residency by Best Western in January to the database.

“Extended-stay hotel demand is rising, but April’s gain was the smallest in 15 months,” said Mark Skinner, partner at The Highland Group.

Supply comparisons

April marked 43 consecutive months of supply growth at 4 percent or less, with annual growth between 1.8 percent and 3.1 percent over the past three years—below the long-term average of 4.9 percent.

The 10.6 percent rise in economy extended-stay supply and minimal change in mid-price and upscale segments mainly reflect conversions. New economy construction accounts for only 3 to 4 percent of rooms opened compared to a year ago.

Supply changes also reflect rebranding shifting rooms between segments, de-flagging of hotels failing brand standards and sales of some hotels to apartment companies and municipalities. Conversion activity is expected to decline soon, keeping total extended-stay supply growth for 2025 below the long-term average.

Revenues remain flat

April’s total extended-stay hotel room revenues were flat year-over-year. In comparison, STR/CoStar reported a 0.4 percent rise in overall hotel room revenues, driven by luxury and upper-upscale segments with minimal extended-stay supply.

STR/CoStar reported April room revenues fell 3.9 percent for economy hotels and 1.7 percent for midscale hotels year-over-year. Upscale hotel room revenues declined 1.1 percent over the same period.

Excluding the February 2024 leap year effect, extended-stay hotel demand rose 0.7 percent in April—the smallest gain since January 2024. By comparison, STR/CoStar reported total hotel demand fell 1.2 percent in April. Adjusting for the extra day last year, extended-stay demand has increased in 28 of the past 29 months.

Key metrics overview

Extended-stay hotel occupancy fell 2.9 percent in April, the fourth consecutive monthly decline and the largest drop since July 2022. This exceeded the 1.9 percent occupancy loss STR/CoStar reported for all hotels. Extended-stay occupancy was 10.6 percentage points above the total hotel industry in April, near the lower end of its historical premium range.

Extended-stay hotel ADR declined in April for the first time since March 2024. This partly reflects a higher share of economy segment supply in April 2025 versus April 2024. Economy and mid-price extended-stay segments posted ADR gains, while STR/CoStar reported ADR declines of 0.6 percent and 0.4 percent for all economy and mid-price hotels, respectively. Upscale hotel ADR fell 0.3 percent, according to STR/CoStar.

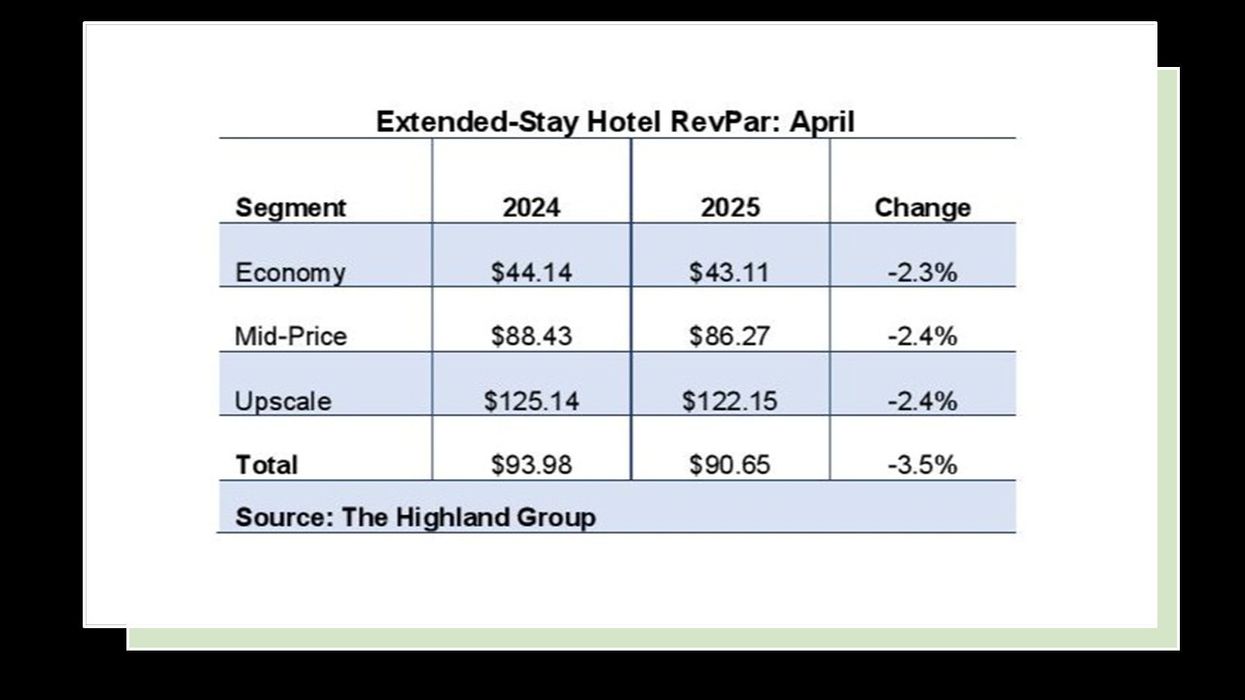

Extended-stay hotel RevPAR fell 3.5 percent in April, the first monthly decline since September 2024. The overall drop was larger than individual segment declines due to a significantly higher economy segment share of extended-stay supply compared to April 2024. STR/CoStar reported April RevPAR declines of 3 percent for all economy and mid-price hotels and 2.3 percent for all upscale hotels.

The Highland Group recently reported that economy, mid-price and upscale extended-stay segments led first quarter 2025 RevPAR growth over their class counterparts. About 602,980 extended-stay rooms were open at quarter-end, with a net gain of 17,588 rooms over the past year—the largest annual increase in three years.