THE VETERAN’S DAY calendar shift led to mixed year-over-year performance comparisons for the U.S. hotel industry in the second full week of November, according to CoStar. Tampa, Florida, saw the most improved performance among the top 25 markets.

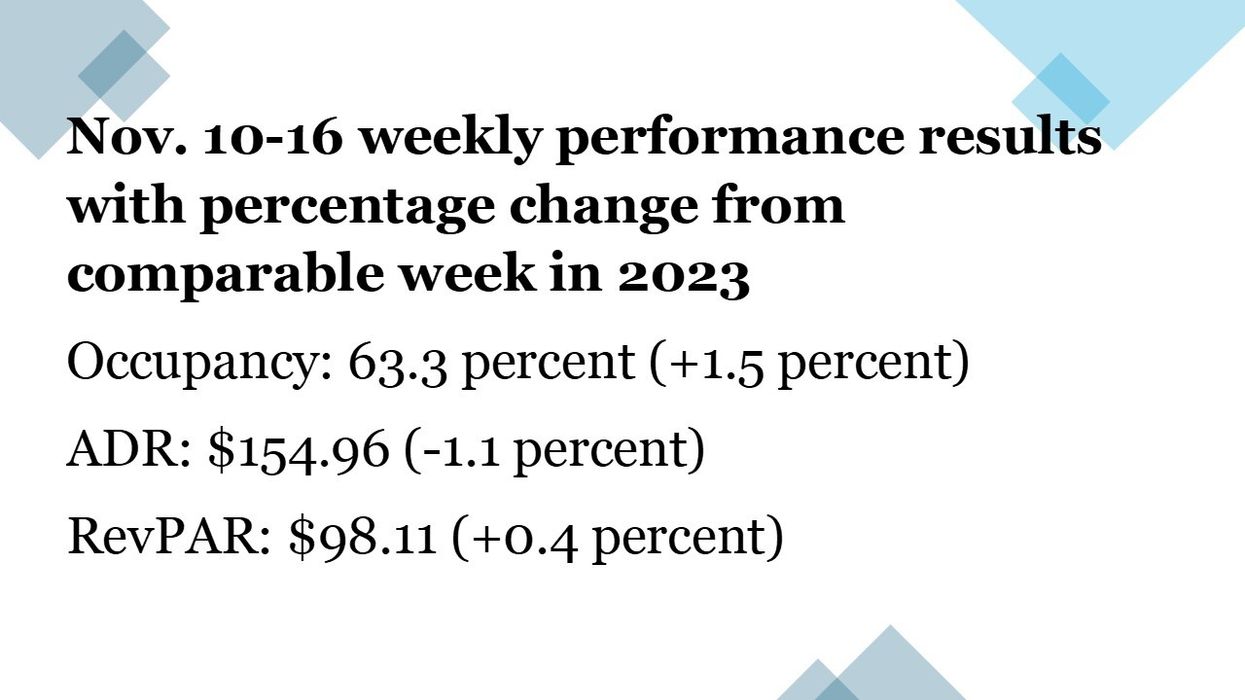

Occupancy rose to 63.3 percent for the week ending Nov. 16, up from 62.6 percent the prior week and a 1.5 percent year-over-year increase. ADR dropped to $154.96 from $156.11, reflecting a 1.1 percent year-over-year decline. RevPAR grew to $98.11 from $97.73, showing a 0.4 percent increase compared to the same week in 2023.

Continued displacement demand from Hurricane Milton led to Tampa seeing the largest increases across each of the performance metrics, with occupancy rising 30.3 percent to 87.2 percent, ADR up 17.4 percent to $176.73 and RevPAR increasing 52.9 percent to $154.16.

The steepest RevPAR declines were seen in Las Vegas, dropping 47.1 percent to $136.28, and San Francisco, decreasing 27.8 percent to $139.74. Las Vegas’ performance was impacted by the Formula 1 calendar shift.