U.S. HOTEL PERFORMANCE exhibited mostly positive year-over-year trends in the first week of March, compared to the previous week, according to CoStar. Despite a slight increase in occupancy, ADR declined, while RevPAR remained static.

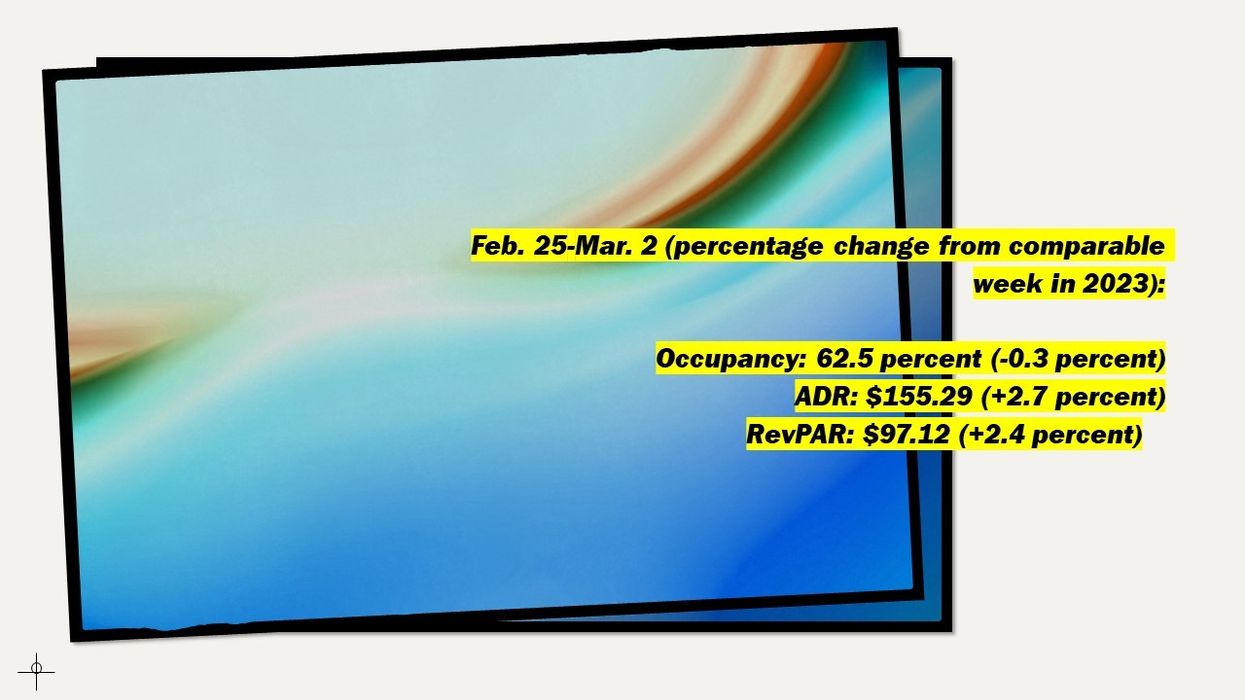

Occupancy rose to 62.5 percent for the week ending March 2, up from the previous week's 62 percent, marking a 0.3 percent year-over-year decline. ADR decreased to $155.29 from $156.62 the prior week, reflecting a 2.7 percent increase compared to the previous year. RevPAR remained unchanged at $97.12 from the prior week's $97.12, indicating a 2.4 percent increase compared to the same period in 2023.

Among the top 25 markets, Seattle reported the largest year-over-year occupancy increase, rising 12.1 percent to reach 66.5 percent.

Benefiting from the NAHB International Builders’ Show, Las Vegas recorded the highest growth in ADR, increasing by 25.4 percent to $249.30, and RevPAR, rising by 36.5 percent to $217.82.

The most significant RevPAR declines occurred in Detroit, dropping 9.8 percent to $66.13, and St. Louis, decreasing by 8.3 percent to $62.56.