U.S. HOTEL INDUSTRY reported lower performance results in the first week of June from the previous week, according to CoStar. However, there was slightly positive comparisons year over year. All key metrics including occupancy, RevPAR and ADR were down compared to prior week.

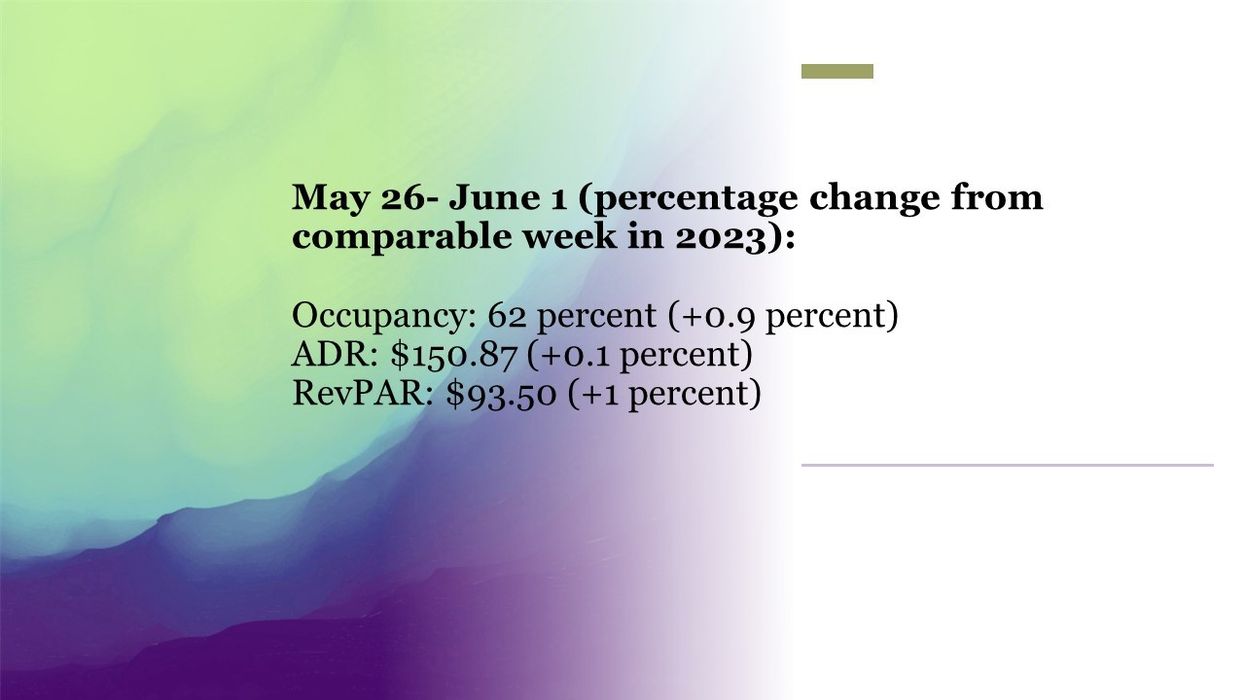

Occupancy declined to 62 percent for the week ending June 1, down from 67.7 percent the prior week, reflecting a 0.9 percent year-over-year increase. ADR decreased to $150.87 from $160.67, yet still showed a 0.1 percent increase compared to last year. RevPAR stood at $93.50, a decline from the previous week’s $108.73, but marking a 1 percent increase compared to the same period in 2023.

Among the top 25 markets, New Orleans experienced the highest year-over-year occupancy increase, rising 17.8 percent to 66.8 percent.

Las Vegas reported the largest ADR increase, up 7.4 percent to $177.13. Dallas saw the biggest jump in RevPAR, rising 22.5 percent to $86.07, and the second-highest ADR increase, up 6.9 percent to $120.55. Severe storms in the area boosted performance after many residents were left without power.

The steepest RevPAR declines were in Washington, D.C., down 10.3 percent to $105.24, and Denver, down 7.6 percent to $93.92.