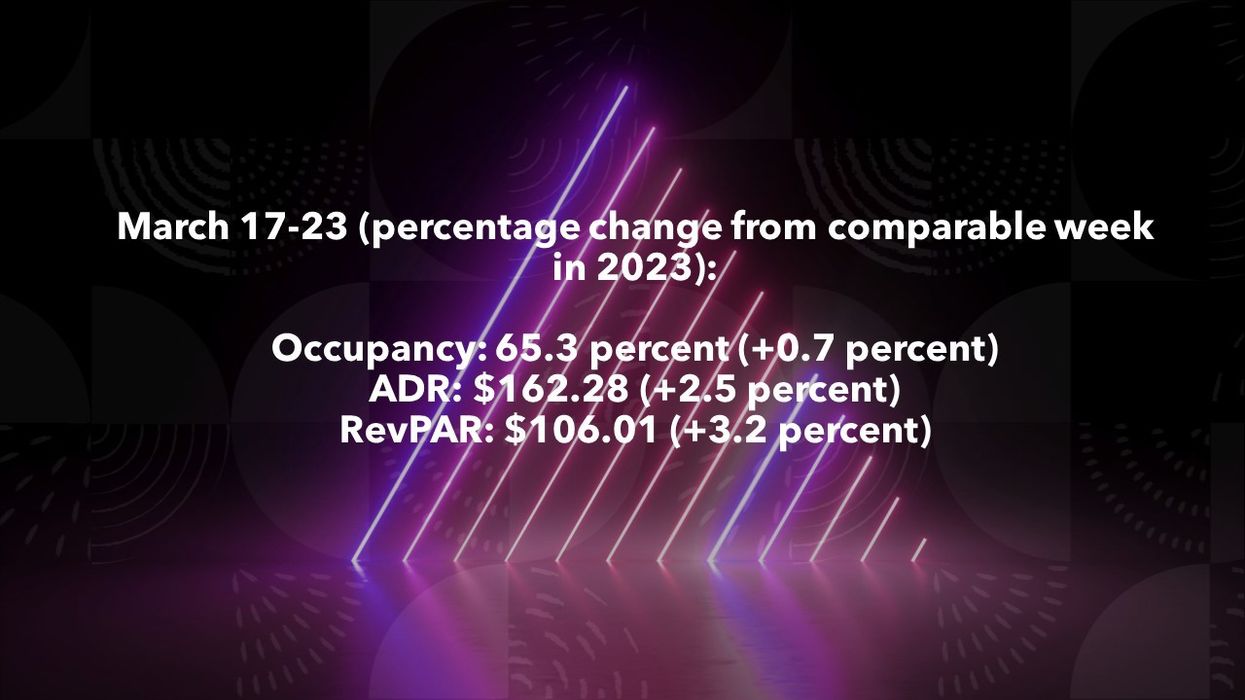

U.S. HOTEL PERFORMANCE dipped in the fourth week of March compared to the previous week but showed positive year-over-year comparisons, according to CoStar. Across all key metrics—occupancy, ADR, and RevPAR—there was a decline in this period compared to the preceding week.

Occupancy dropped to 65.3 percent for the week ending March 23, down from the previous week's 66.5 percent, with a 0.7 percent year-over-year increase. ADR decreased to $162.28 from the previous week's $163.21, showing a 2.5 percent climb compared to last year. RevPAR was $106.01, down from the previous week's $108.51, indicating a 3.2 percent increase compared to the same period in 2023.

Among the top 25 markets, New Orleans saw the highest year-over-year occupancy increase, rising 13.6 percent to 75.5 percent.

Las Vegas achieved the highest ADR growth, up 14.2 percent to $217.27.

The steepest RevPAR declines occurred in Chicago, which decreased by 12 percent to $87.95, and Nashville, which dropped by 10 percent to $131.14.