U.S. HOTEL PERFORMANCE declined in the first week of October compared to the previous week due to Rosh Hashanah, according to CoStar. Year-over-year comparisons also decreased, with key metrics—occupancy, RevPAR, and ADR—all falling from the prior week.

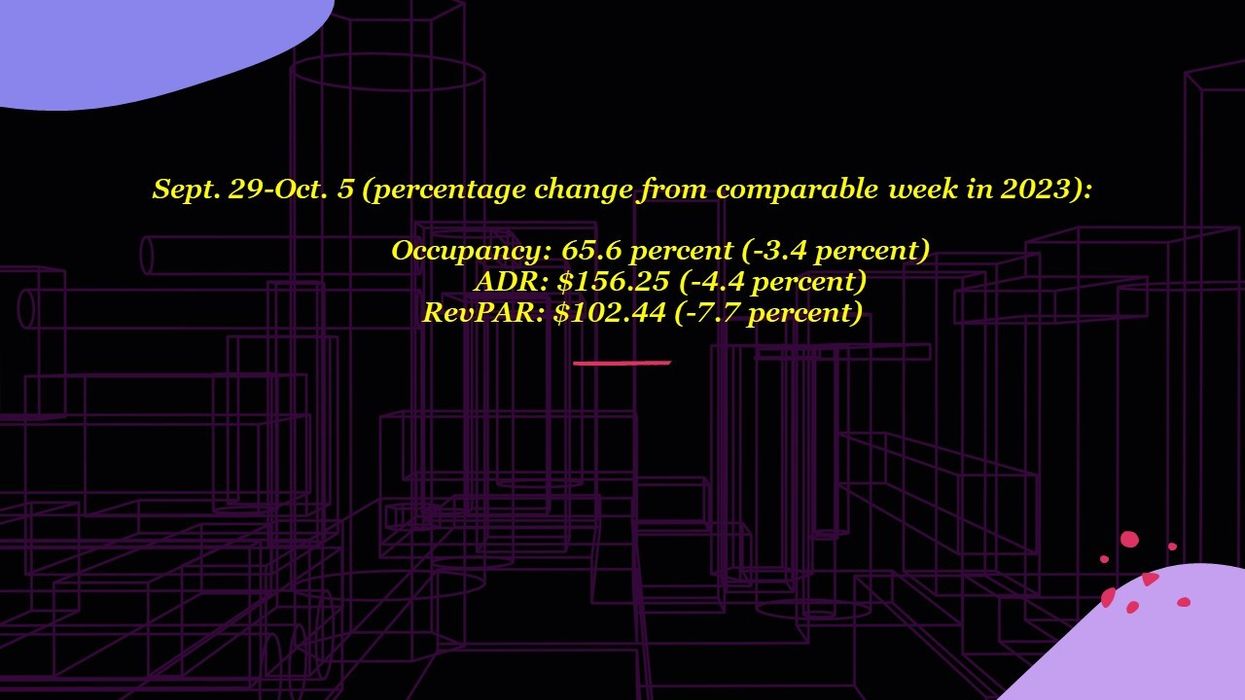

Occupancy fell to 65.6 percent for the week ending Oct. 5, down from 69.4 percent the previous week, reflecting a 3.4 percent year-over-year decrease. ADR decreased to $156.25 from $159.63 the prior week, indicating a 4.4 percent decline compared to last year. RevPAR dropped to $102.44, down from $110.84 the previous week, marking a 7.7 percent decrease compared to the same period in 2023.

Among the top 25 markets, Tampa saw the highest year-over-year occupancy increase at 81.3 percent, up 24.1 percent, while RevPAR rose 22.1 percent to $125.39. As is common after natural disasters, the market’s hotel performance was boosted by displacement demand from Hurricane Helene.

Las Vegas and Chicago saw the steepest RevPAR declines, falling 25.9 percent to $118.51 and 25.8 percent to $115.05, respectively.