U.S. HOTEL PERFORMANCE declined in the fourth week of April compared to the previous week and the corresponding period last year, as expected during Passover, according to CoStar. All key metrics, including occupancy, RevPAR and ADR, experienced a decrease compared to the previous week.

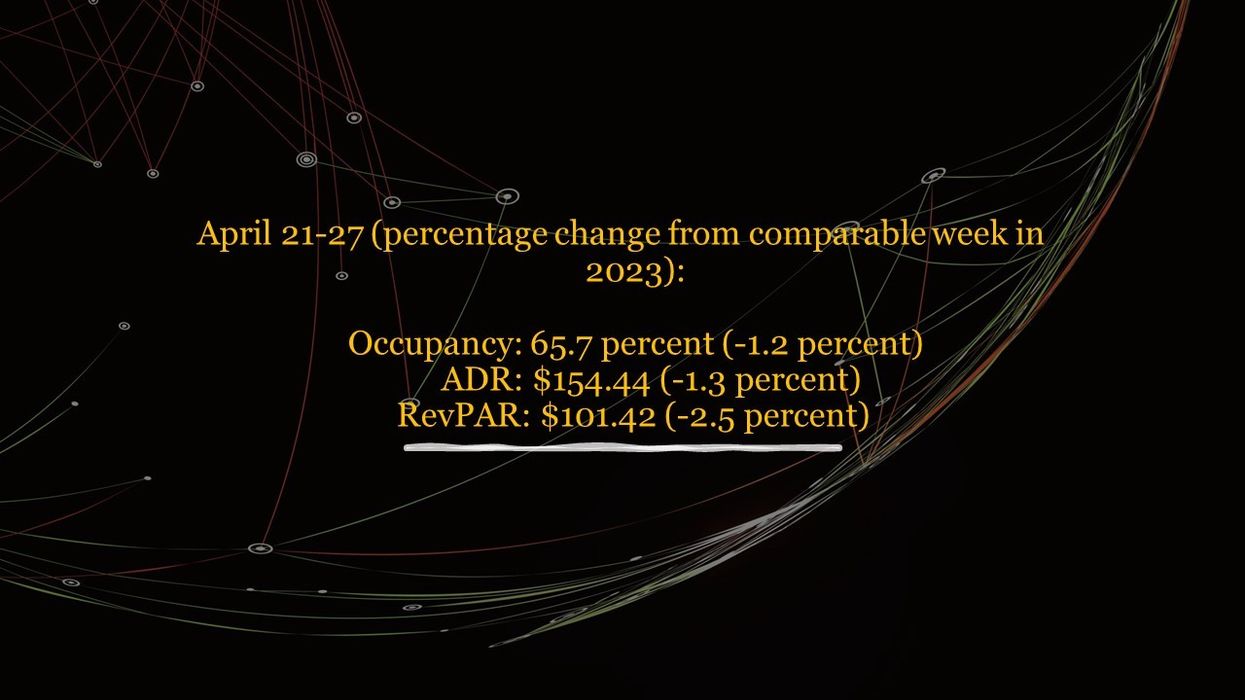

Occupancy came in at 65.7 percent for the week ending April 27, down from the previous week's 66.8 percent, while marking a 1.2 percent year-over-year decrease. ADR decreased to $154.44 from $158.60, reflecting a 1.3 percent decline compared to last year. RevPAR stood at $101.42, down from $105.94 the prior week, indicating a 2.5 percent dip compared to the same period in 2023.

Among the top 25 markets, Seattle reported the sole double-digit increase in occupancy, rising by 15.6 percent to 74.6 percent. Detroit, host of the NFL Draft, saw the most significant surge in both ADR, rising by 21.8 percent to $147.83, and RevPAR, increasing by 25.6 percent to $94.74.

The steepest decreases in each of the three key performance metrics occurred in San Francisco/San Mateo: occupancy declined by 16.7 percent to 67.5 percent, ADR dropped by 37.3 percent to $190.91, and RevPAR dipped by 47.7 percent to $128.79.