U.S. HOTEL PERFORMANCE saw an uptick in the second week of April compared to the previous week, driven by the total solar eclipse, according to CoStar. Across all key metrics—occupancy, ADR, and RevPAR—there was an increase from the preceding week.

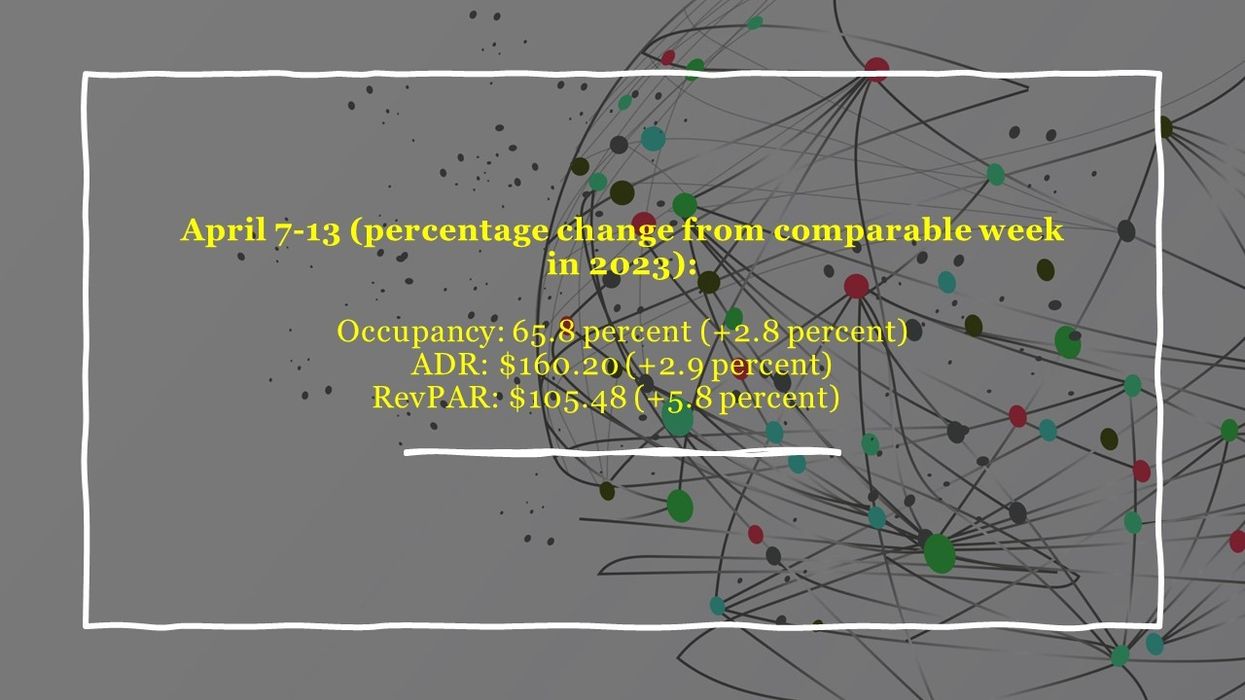

Occupancy reached 65.8 percent for the week ending April 13, up from the previous week's 64.1 percent, marking a 2.8 percent year-over-year increase. ADR rose to $160.20 from $156.96, reflecting a 2.9 percent increase compared to last year. RevPAR increased to $105.48 from $100.59 the previous week, indicating a 5.8 percent rise compared to the same period in 2023.

Among the top 25 markets, Philadelphia saw the most significant year-over-year occupancy surge, rising by 23.2 percent to reach 77 percent, with RevPAR also experiencing a notable increase of 45.7 percent to $133.79, attributed to WrestleMania 40.

Dallas, situated along the solar eclipse path, recorded the highest ADR increase, up by 20.1 percent to $150.33, along with the second-highest RevPAR jump, rising by 38.8 percent to $117.50.

The most significant RevPAR declines were observed in Tampa, dropping by 24.1 percent to $135.79, and Orlando, which fell by 20.9 percent to $134.48.