U.S. HOTEL PERFORMANCE improved in the second week of October compared to the previous week, with positive year-over-year comparisons due to the Columbus Day/Indigenous Peoples' Day calendar shift, according to CoStar. Key metrics, including occupancy, RevPAR and ADR, saw week-over-week increases.

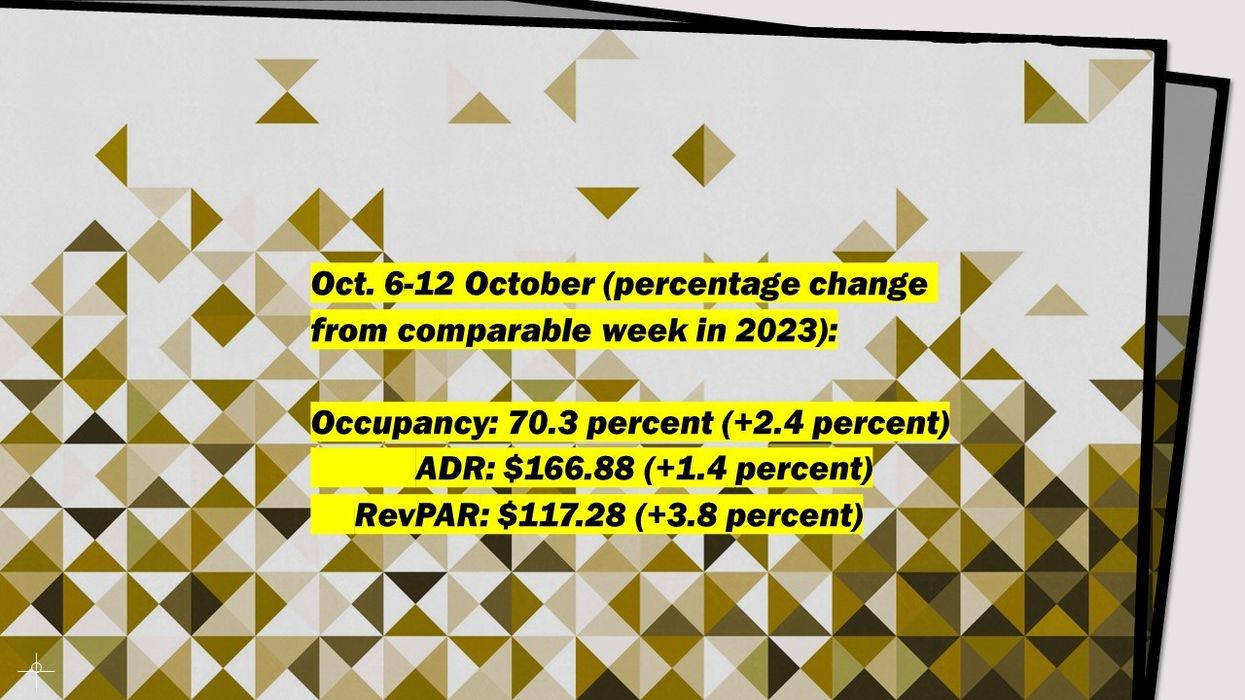

Occupancy increased to 70.3 percent for the week ending Oct. 12, up from 65.6 percent the previous week, marking a 2.4 percent year-over-year rise. ADR rose to $166.88 from $156.25, reflecting a 1.4 percent increase compared to last year. RevPAR reached $117.28, up from $102.44 the prior week, showing a 3.8 percent increase from the same period in 2023.

Among the top 25 markets, New Orleans recorded the highest year-over-year increases: occupancy rose 20.1 percent to 75.6 percent, ADR increased 13.1 percent to $194.70, and RevPAR grew 35.9 percent to $147.18, driven by the Water Environment Federation's Technical Exhibition and Conference.

Atlanta experienced the second-highest increases in occupancy, rising 15.6 percent to 77.5 percent, and RevPAR, which increased 20.6 percent to $102.59, due to displacement demand from Hurricane Milton.

The steepest RevPAR declines were in Oahu Island, down 10.3 percent to $218.20, and Tampa, down 9.8 percent to $88.67, the latter affected by Hurricane Milton.