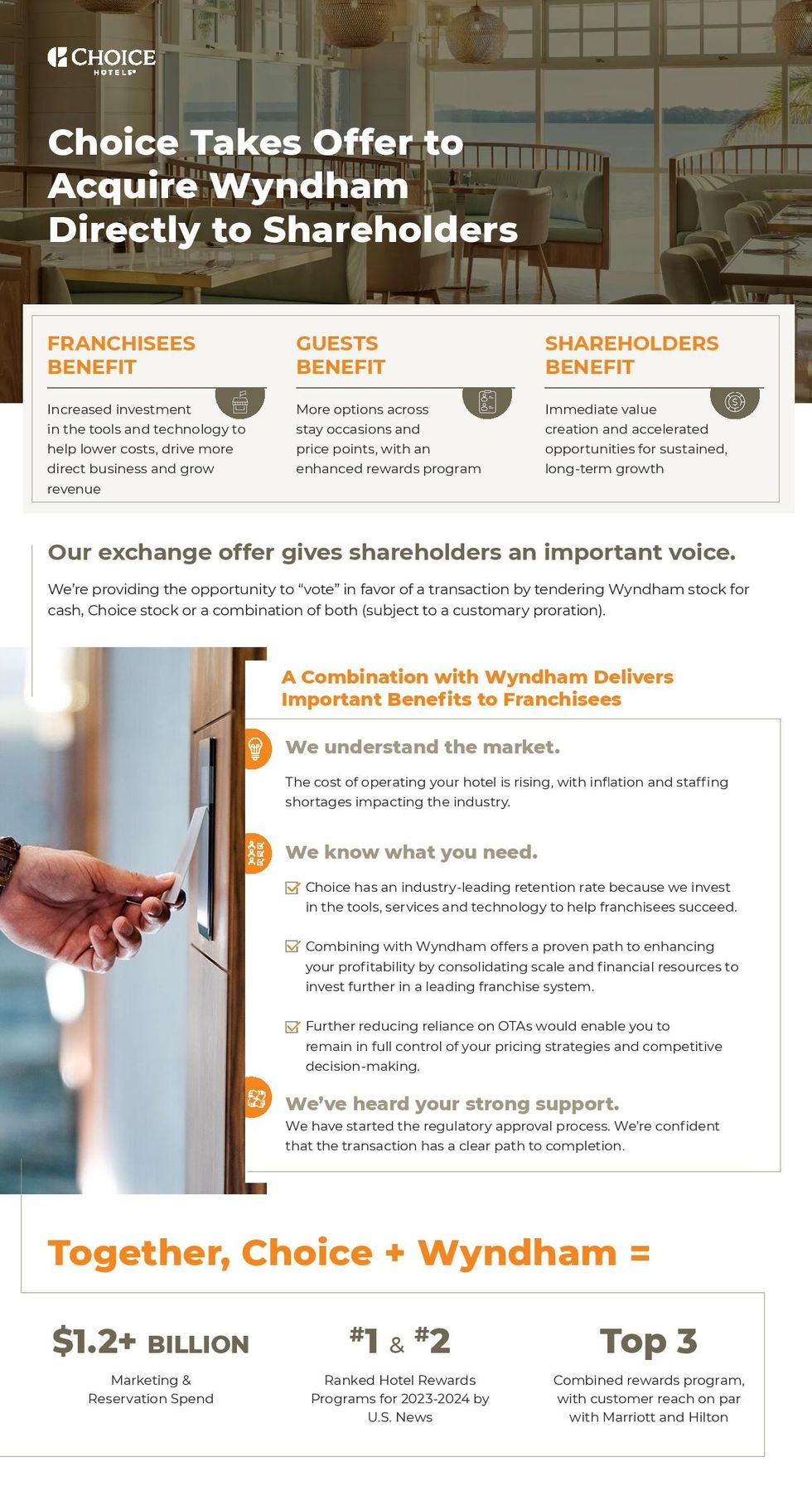

CHOICE HOTELS INTERNATIONAL is accusing the board of directors for Wyndham Hotels & Resorts of not being forthcoming with the company’s shareholders regarding Choice’s exchange offer to acquire Wyndham. In its counter to the Wyndham board’s rejection of the offer, Choice took issue with Wyndham’s concerns about getting regulatory approval for the deal and said Wyndham shareholders support the “industrial merits of a transaction.”

In its original proposal, made public in October, Choice said it sought to acquire all the outstanding shares of Wyndham at a price of $90 per share and shareholders would have received $49.50 in cash and 0.324 shares of Choice common stock for each Wyndham share they own. Choice claimed that is a 30 percent premium to Wyndham’s 30-day volume-weighted average closing price ending on Oct. 16, an 11 percent premium to Wyndham’s 52-week high, and a 30 percent premium to Wyndham’s latest closing price.

Wyndham’s board unanimously rejected Choice’s proposal, calling it unsolicited, “highly conditional” and not in the best interest of shareholders. On Nov. 14, however, Choice sent a letter to the Wyndham board with an “enhanced proposal” intended to address Wyndham’s concerns about clearing federal regulations. On Dec. 12, Choice launched its public exchange offer to acquire Wyndham and on Dec. 19 the Wyndham board officially rejected the offer and urged shareholders not to tender shares for the deal.

Choice claims deal is in best interest of Wyndham shareholders

Choice issued its rebuttal days after Wyndham’s board issued its reasons for rejecting the most recent offer. Choice said the position of Wyndham’s board “threatens shareholders ability to realize value.”

“Wyndham shareholders should be concerned by the company's blatant mischaracterization of the lodging industry's competitive landscape. Wyndham's comments call into question their ability to properly support franchisees while also generating shareholder value through M&A,” the Choice statement said. “The U.S. Federal Trade Commission will come to its own independent assessment of the proposed transaction's competitive merits based on the specific facts, like it does on every M&A transaction. Attempting to use the FTC to prevent Wyndham shareholders from even accessing the option of a merger with Choice robs them of meaningful upside from the combination or, at a minimum, the substantial break-fee Choice has offered in the unlikely event the transaction were not to receive the requisite regulatory clearance.”

Choice also said that after it made its public offer on Dec. 12 to acquire all outstanding shares of Wyndham, representatives of that company contacted Choice and offered to restart discussions on the acquisition. However, five days later Wyndham withdrew again from the talks and did not disclose the discussions in the Schedule 14d-9 that it filed.

Choice went on to say it had found some support for the idea of an acquisition among Wyndham shareholders. It also said previously that it planned to nominate candidates for Wyndham's board at its meeting next year.

“Since launching the exchange offer, we have engaged with dozens of Wyndham's institutional shareholders representing over 40 percent of shares outstanding based on the most recently available filings. In our discussions, many shareholders have consistently expressed support for the industrial merits of a transaction as well as the desire for both parties to work together to reach an expedient resolution,” Choice said. “We remain confident we can complete the transaction within a one-year customary timeframe and are committed to moving forward with this process. We have already started the regulatory clock, and look forward to continuing to work closely with the FTC to support a fact-based review process grounded in the reality of this industry's evolving competitive landscape.”