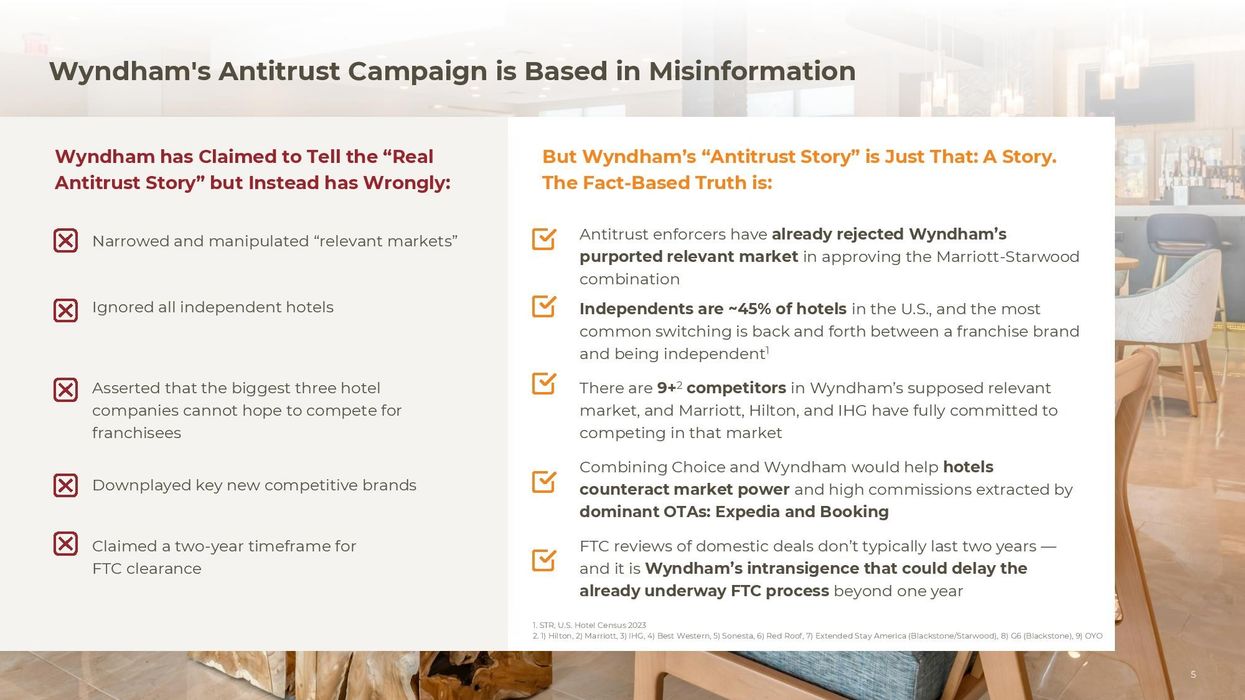

IN ITS LATEST drive to convince Wyndham Hotels & Resorts stakeholders to accept its proposed acquisition of the company, Choice Hotels International has released a detailed presentation accusing Wyndham of making misleading statements regarding the antitrust aspects of the deal. The specific accusations include that Wyndham is manipulating data on how the hotel industry works, the competition a Choice-Wyndham combination would face and the benefits of the merger for franchisees.

Choice filed the presentation with the U.S. Securities and Exchange Commission and is also available at CreateValueWithChoice.com, the company said in a statement. Choice’s presentation was released nearly three weeks after Wyndham’s latest statement in which it said Choice was not being forthcoming with Wyndham shareholders regarding its offer.

"We are disappointed Wyndham is pushing this disinformation campaign. Their take on the antitrust risk on our proposed combination is misleading and further reflects the board's apparent entrenchment,” said Patrick Pacious, Choice’s president and CEO. “Wyndham's characterization of the lodging industry's competitive landscape and relevant regulatory criteria is incorrect. Our pro-competitive combination is well positioned to obtain approval, and we remain committed to completing it for the benefit of both companies' franchisees, shareholders and guests."

In its original proposal, made public in October, Choice said it sought to acquire all the outstanding shares of Wyndham at a price of $90 per share and shareholders would have received $49.50 in cash and 0.324 shares of Choice common stock for each Wyndham share they own. Choice claimed that is a 30 percent premium to Wyndham’s 30-day volume-weighted average closing price ending on Oct. 16, an 11 percent premium to Wyndham’s 52-week high, and a 30 percent premium to Wyndham’s latest closing price.

Wyndham’s board unanimously rejected Choice’s proposal, calling it unsolicited, “highly conditional” and not in the best interest of shareholders. On Nov. 14, however, Choice sent a letter to the Wyndham board with an “enhanced proposal” intended to address Wyndham’s concerns about clearing federal regulations. On Dec. 12, Choice launched its public exchange offer to acquire Wyndham and on Dec. 19 the Wyndham board officially rejected the offer and urged shareholders not to tender shares for the deal.

It's in the details

Choice’s presentation makes three basic contentions with Wyndham’s arguments against the merger, based primarily on the latter’s concerns that the deal would not be approved by federal authorities. Those contentions are:

- Wyndham’s portrayal of the current lodging industry is inaccurate in several ways, Choice says. For example, Wyndham segments hotels based on STR chain scales that have no meaning under antitrust laws. Also, Choice and Wyndham account for 10 percent of room revenue, and Wyndham does not take into account the competition between hotel brands for guests and franchisees along with the fact that brands move up and down STR’s chain scales. Wyndham also doesn’t include independent hotels in its definition of the market although they make up 45 percent of that market. “Wyndham's overly narrow definition of the market is contradicted by clear legal and regulatory precedent and has already been rejected by antitrust enforcers in their approval of the Marriott-Starwood combination,” Choice said.

- Wyndham's market definition does include nine other major competitors, including Marriott International, Hilton, and IHG Hotels & Resorts. Choice said Wyndham has implied that even these large companies would not be able to compete with a combined Choice-Wyndham for franchisees, but they are already competing. Wyndham also is not considering the growing competition the STR midscale and economy segments.

- Wyndham and Choice franchisees would benefit from the merger in several ways, Choice said. They would see reduced costs, higher profitability and have the ability to compete against larger brand rivals. They also would better compete with OTAs, which currently account for more than half of online hotel bookings and have a marketing spend that is 10 times larger than Choice and Wyndham combined, Choice said.

Second Request accepted

Choice said it is “proceeding along the expected path of regulatory review” with the U.S. Federal Trade Commission. The company said the FTC’s Second Request process began on Jan. 11 and it remains confident that it can complete the combination within a one-year customary timeframe.

Wyndham acknowledged receiving the 40-page, 65-topic Second Request. It’s resistance to the proposal remained.

"From the beginning, Wyndham has consistently stated that this transaction would be subject to an FTC Second Request, and therefore the FTC's decision to issue one is no surprise," said Stephen Holmes, Wyndham’s chairman of the board. "Choice, on the other hand, continues to ignore the significant risk this poses to our shareholders, and mischaracterize how the FTC will define the relevant market. The protracted review process – with an unpredictable timeline and outcome – would substantially reduce the value of Choice's offer and disrupt Wyndham's business."

Wyndham said it will comply fully with the FTC's Second Request. The start of the Second Request extends the 30-day waiting period imposed by the Hart-Scott-Rodino Antitrust Improvements Act of 1976. The company said independent third parties share its concerns about the merger.

"The Second Request, which is issued in only around 1 percent of deals reviewed by the FTC, marks the start of a complex, lengthy process as both parties provide the FTC with the terabytes of data and documents it has requested, with an uncertain outcome and no guarantee of closing,” Holmes said. “Despite the distraction, the board and management team will continue to execute Wyndham's standalone strategy with a focus on providing shareholders with long-term, sustainable value."