CHOICE HOTELS INTERNATIONAL has named its eight nominees for the board of directors for Wyndham Hotels & Resorts to be voted on in Wyndham’s 2024 shareholder meeting. The nominees, including Jay Shah, executive chairman at Hersha Hospitality Trust, are expected to support Choice’s bid to acquire Wyndham despite multiple rejections by the latter.

In response, Wyndham said it will evaluate the nominees as part of its due diligence, but it also said the nominees were “hand-picked to push through their offer.” Along with Shah, Choice’s nominees are:

- Barbara Bennett, founder and principal executive of business consulting firm Bennett West LLC.

- Emanuel Pearlman, founder, chairman and CEO of investment management and financial consulting firm Liberation Investment Group.

- Fiona Dias, digital commerce consultant who served as the chief strategy officer of online shopping service ShopRunner from 2011 to 2014.

- James Nelson, CEO of real estate investment trust Global Net Lease, Inc.

- Nana Mensah, founder, chairman and CEO of food packaging and processing equipment exporter 'XPORTS Inc.

- Susan Schnabel, founder and co-managing partner of buyout fund advisor aPriori Capital Partners.

- William Grounds, principal of his advisory business Burraneer Capital Advisors LLC.

"These nominees are proven leaders with wide-ranging expertise across relevant industries, including deep proficiency in the hospitality and franchising sectors,” said Stewart Bainum, chairman of Choice's board of directors. “We are confident the nominees' industry, finance, governance and board experience will greatly benefit Wyndham shareholders. Most importantly, if elected, the nominees will exercise their independent judgment to serve Wyndham shareholders' best interests, which Choice believes is to move with urgency to maximize the value that could be created for them through a combination with Choice."

Choice, which last week accused Wyndham of spreading misinformation about the deal’s likelihood to pass the Federal Trade Commission’s approval for the deal, said its nominees “understand the nuances of the franchising model and the increasing pressure franchisees face from rising operating costs, larger hotel chains and dominant online travel agencies.”

"With this slate of independent, highly qualified candidates for election to the Wyndham board, Wyndham shareholders will have an opportunity to be represented by a board that will fulfill its fiduciary duty to act in the shareholders' best interests and consider any and all paths to create value,” said Patrick Pacious, Choice president and CEO. “Unfortunately, the current Wyndham Board continues to refuse to engage in meaningful negotiations regarding a combination with Choice that would create extraordinary value. By supporting these nominees and participating in our exchange offer, Wyndham shareholders can send a clear message to the Wyndham board."

Hersha did not respond to Asian Hospitality’s request for a comment from Shah in time for this article.

Wyndham not moved

Wyndham’s board acknowledged receipt of the list of Choice’s nominees but said it still recommended that shareholders not tender their shares toward the merger.

"This action is yet another attempt by Choice to advance its inadequate and risk-laden hostile exchange offer, which the Wyndham board unanimously determined is not in the best interests of shareholders. Wyndham's board and management team are executing the company's strategic plan, which is expected to deliver shareholder value well in excess of Choice's offer,” the board said. "Choice's proxy contest is a blatant scheme to mislead shareholders into packing the Wyndham board with nominees hand-picked to push through their offer. As Stewart Bainum, controlling shareholder and chairman of Choice, brazenly telegraphed in a press release this morning, Choice has assembled and paid a slate with a sole, dubious goal in mind: advance Choice's misguided and self-serving acquisition agenda.”

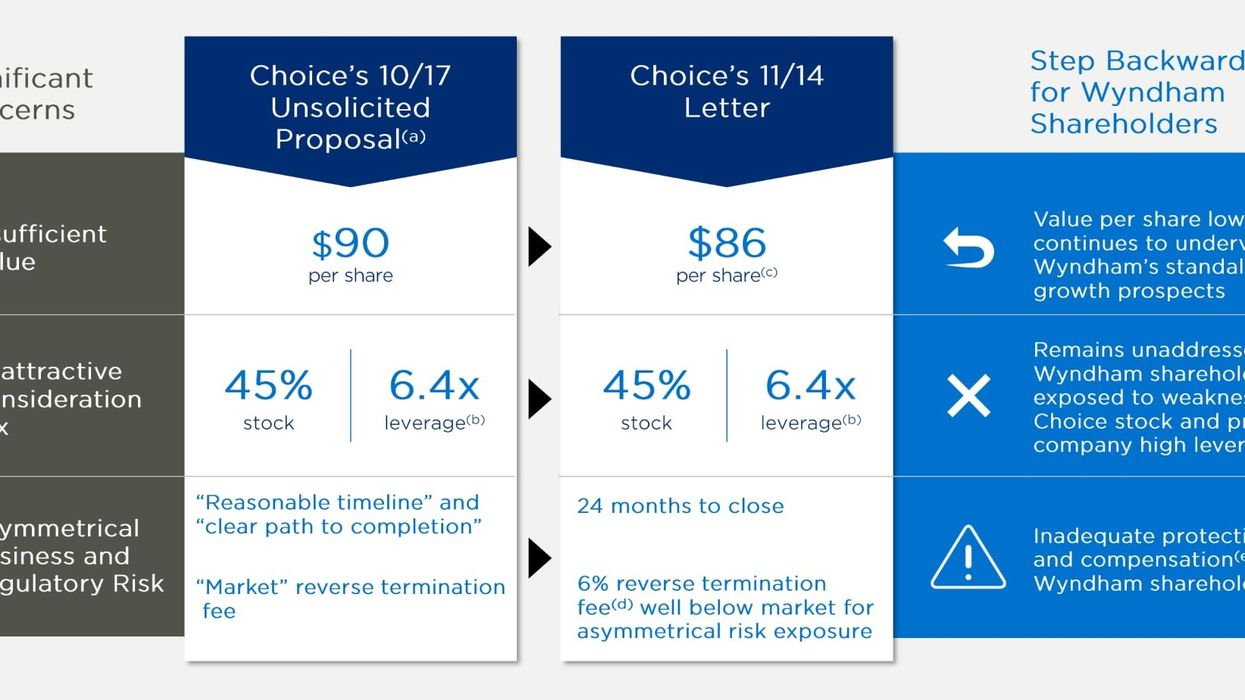

In its original proposal, made public in October, Choice said it sought to acquire all the outstanding shares of Wyndham at a price of $90 per share and shareholders would have received $49.50 in cash and 0.324 shares of Choice common stock for each Wyndham share they own. Choice claimed that is a 30 percent premium to Wyndham’s 30-day volume-weighted average closing price ending on Oct. 16, an 11 percent premium to Wyndham’s 52-week high, and a 30 percent premium to Wyndham’s latest closing price.

Wyndham’s board unanimously rejected Choice’s proposal, calling it unsolicited, “highly conditional” and not in the best interest of shareholders. On Nov. 14, however, Choice sent a letter to the Wyndham board with an “enhanced proposal” intended to address Wyndham’s concerns about clearing federal regulations. On Dec. 12, Choice launched its public exchange offer to acquire Wyndham and on Dec. 19 the Wyndham board officially rejected the offer and urged shareholders not to tender shares for the deal.

Wyndham’s board said it has met at least 10 times to evaluate Choice's proposals and engaged with Choice at least 25 times since its first approach in April. It said it would process Choice’s candidates but did not consider them necessary.

“We are confident we have the right board composition to position Wyndham for continued long-term success and value creation," the board said.

Wyndham has not yet set a date for its 2024 shareholder meeting, a spokesperson said.