PURSUING SUSTAINABILITY THROUGH ambitious climate and decarbonization efforts has heightened the demand for electrified and energy-efficient buildings. Regulatory frameworks are evolving from simple incentives to stringent compliance measures, according to an article from CBRE Hotels Research.

Recently, states and cities have enacted building performance standards that mandate energy performance and emissions reductions, as well as implementing benchmarking and transparency policies. As a result, real estate operators must meet these standards to mitigate financial risks associated with non-compliance, further motivating them to enhance performance.

Simultaneously, utilities and third-party program administrators are tasked with meeting multi-year energy savings targets, concentrating on initiatives like peak demand reductions. This alignment of incentives fosters cooperation between utility providers and business consumers to identify energy reduction opportunities.

Stakeholder demand amplifies this shift, as investors, consumers, and employees increasingly expect organizations to prioritize sustainability. According to the U.S. Travel Association, nine out of 10 travelers seek sustainable travel options. Additionally, 76 percent of business executives prefer corporate travel choices that uphold sustainability, even at a higher cost. Recent data reveals a 102 percent increase in companies setting science-based greenhouse gas-reduction targets in 2023, and 85 percent of large company respondents in CBRE’s 2024 Americas Office Occupier survey reported having a net-zero emissions goal.

As hotel operators recognize that investing in energy efficiency can lower operational costs and enhance cash flow, momentum for sustainability continues to grow. Furthermore, technological advancements, such as AI-driven building management systems and improved battery storage, promise to help streamline energy management, positioning hotels and other commercial properties to thrive while reducing their emissions—all while maximizing guest comfort.

The Rising Cost of Utilities

Recent trends in energy markets reveal a persistent upward trajectory in utility prices, making it imperative for property managers to seek efficiency improvements proactively. The COVID-19 pandemic triggered sharp spikes in electricity and natural gas prices, and market volatility has continued due to market disruptions, geopolitical tensions and an increase in extreme weather events. While recent declines in natural gas prices may offer some temporary relief, forecasts indicate that overall energy costs are expected to rise. For instance, U.S. electricity prices have grown by 3.6 percent over the past year, outpacing general inflation. Demand for electricity will continue to escalate primarily driven by the rise in electric vehicles, explosion of data center activity, and growing cooling needs due to rising temperatures. Although more reliance on renewable energy sources has helped reduce total generation costs, this transition requires substantial investments in grid modernization and expansion, which will inevitably impact future utility bills.

The landscape for water/sewage is comparable with historical annual increases of approximately 4 percent in water and sewer rates. Strained water resources coupled with the pressing need to modernize aging infrastructure will likely continue pushing higher rates and highlights the need for innovative resource management strategies.

Energy and water efficiency, along with other resource management strategies, will be crucial for sustained business success as electricity demand escalates and water resources become strained. This is particularly relevant for hospitality operations, who run 24/7/365 businesses. Looking for resource conservation measures will enable operators to adeptly navigate the complexities of rising utility costs while enhancing overall operational performance.

Hotel Cost Controls

Despite the rising cost of utilities, one bright spot among hotel expenses the past two years has been utility costs. During 2023 and 2024, hotel utility costs have averaged an increase of 3.5 percent. This is almost half the 6.6 percent increase in total operating expenses during the same time period.

CBRE recently analyzed the utility expenditures of the 3,674 properties in the annual Trends sample. In 2023, these properties averaged 205 rooms, with an average occupancy level of 69.4 percent and an ADR of $203.68. The 2,500 hotels from our monthly Trends survey was used to estimate 2024 performance levels.

Utility Costs Vary by Property Type

Per the 11th edition of the Uniform System of Accounts for the Lodging Industry, utilities expenses consist of the costs for electricity, gas, oil, fuel, steam, water, and sewer.

In 2024, utility costs are estimated to be $2,478 per-available-room annually, or $9.68 on a per-occupied-room basis. Given the extensive services and amenities offered, utility expenses are greatest at resort properties ($4,933 PAR). Fortunately, the diversity of income sources and higher ADRs mutes the impact of utility costs as a percent of revenue (2.9 percent) at this property type.

On the other end of the spectrum, limited-service ($1,446 PAR) and extended-stay ($1,580 PAR) hotels are spending the least on utilities in 2024. However, utility costs have averaged roughly 4 percent of revenue at these hotels given their lower levels of ADR and total revenue.

Variation by Utility Cost Category

On average, hotel utility costs have increased by an estimated 1.4 percent in 2024. Utility expense growth is greatest at extended-stay, full-service, and resort hotels. Operators at convention and limited-service properties have benefited from the least growth in utility costs.

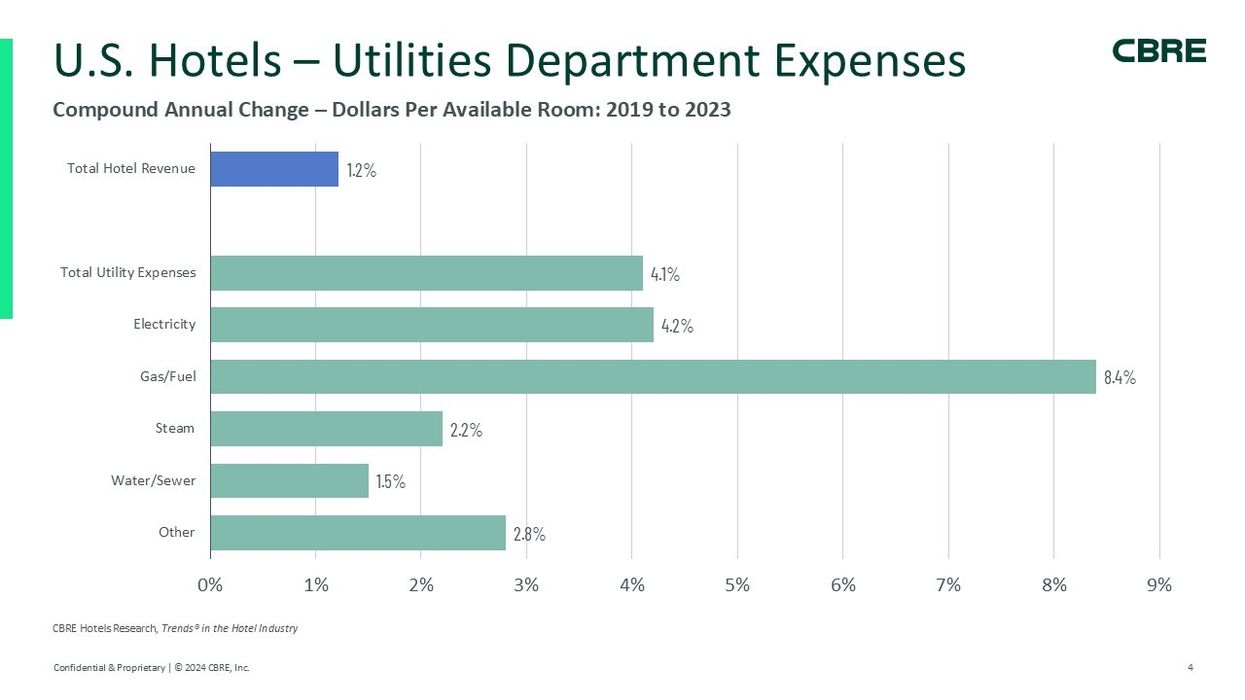

The 1.4 percent increase in utility costs during 2024 is less than the 4.1 percent compound annual growth rate (CAGR) observed from 2019 through 2023. Among the five different utilities expense categories, gas and fuel CAGR increased most sharply between 2019 and 2023 (8.4 percent). Conversely, the amount paid for water and sewer charges rose at a 1.5 percent CAGR over the same period.

The Continued Need to Control Costs

Hotel operators are facing significant challenges in managing resource efficiency, especially considering their unique position as one of the highest energy and water consumers per square foot. With occupancy rates, extreme weather events, and sociopolitical dynamics influencing consumption, hotels have to stay vigilant in managing energy and water use.

According to the August 2024 edition of CBRE’s Hotel Horizons forecast report for the U.S. lodging industry, room revenue is projected to increase at an average annual rate of 2.6 percent through 2026. Given the modest forecast of revenue growth, the need to control expenses will continue.

Ways to Improve Building Resource Efficiency

While many improvements have already been made, such as switching to LED lighting and installing occupancy sensors, significant opportunities for further efficiency remain. Upgrading to more efficient electric heating, cooling, and cooking equipment—especially as older systems reach the end of their life—can yield substantial savings. Additionally, implementing water-saving measures like graywater reuse can enhance efficiencies without compromising daily operations.

One effective strategy is energy load management, where hotels go beyond basic occupancy sensors to adopt automated energy management systems. These systems offer real-time monitoring and centralized control, dynamically adjusting heating and cooling based on room occupancy. For example, hotels can strategically schedule energy-intensive activities, such as charging electric vehicle stations, during off-peak hours to optimize costs and reduce peak demand charges.

Water conservation is equally important. Traditional methods, such as installing faucet aerators and retrofitting fixtures with low-flow options, remain effective. Moreover, hotels are increasingly using smart irrigation systems, implementing rainwater harvesting, and reusing graywater for irrigation. These initiatives not only conserve water and contribute to environmental sustainability but also lead to significant cost savings.

Renewable energy adoption is becoming a priority for hotels, as it reduces carbon emissions and enhances energy security. Onsite renewable solutions are becoming more economically viable, and hotels can benefit from potential tax credits and local incentives. Integrating battery storage systems further enhances energy resilience against grid unreliability.

Beyond traditional approaches, hotels are exploring holistic solutions that incorporate ecosystem services for enhanced sustainability. Implementing green roofs and walls can mitigate the urban heat island effect and improve insulation, leading to additional energy savings. These strategies not only reduce energy demand but contribute to people’s wellbeing through exposure to nature.

By embracing a multifaceted approach to resource efficiency, hotel operators can navigate the complexities of rising utility costs. This strategy enhances guest comfort, supports sustainability initiatives and benefits the bottom line, positioning hotels as leaders in responsible and resilient hospitality.

In November, CBRE revised its industry forecast to predict U.S. hotels’ performance would continue to rebound from a subdued summer into 2025.