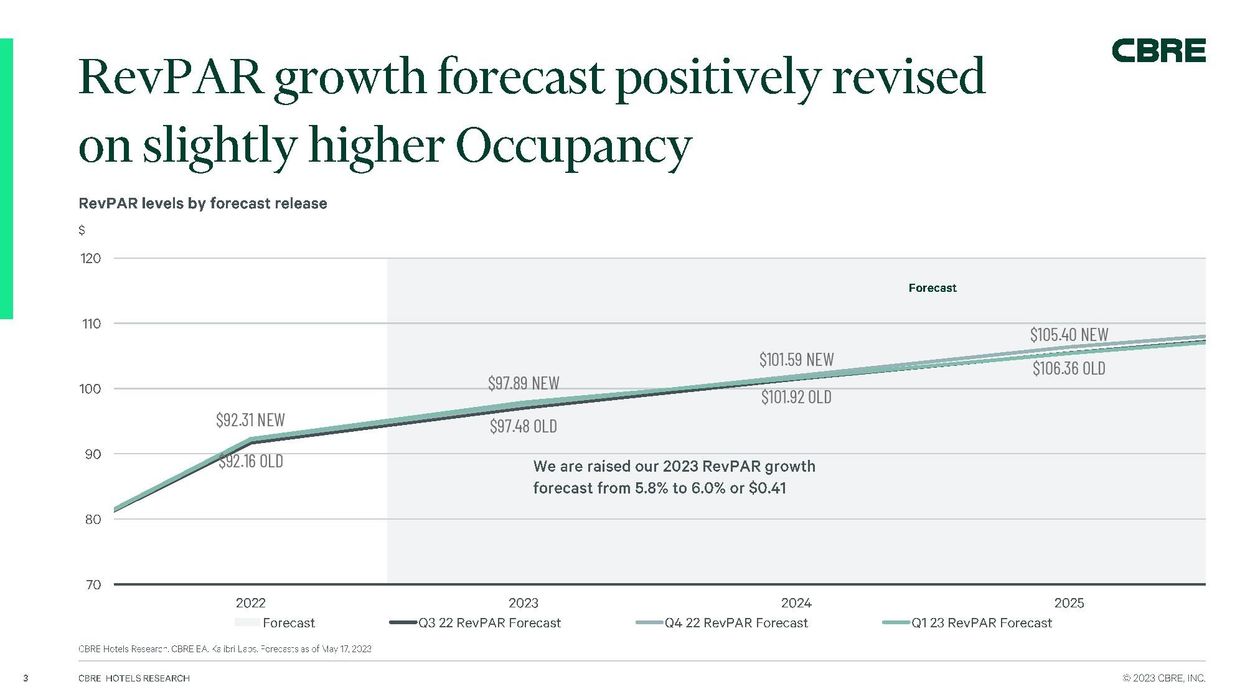

DRIVEN BY STRONGER-than-expected demand and moderate supply, CBRE has raised its forecast for hotel performance again this year, resulting in increased occupancy. CBRE revised its forecast for 2023 RevPAR to $97.89, up 6 percent year-over-year and an increase of $0.43 rise from the previous forecast. This positive revision is based on a 65-basis-point increase in expected occupancy compared to the previous forecast issued in February, CBRE said in a statement.

Furthermore, the ADR is projected to grow by 3.7 percent in 2023, slightly lower than the previous forecast of 4.2 percent. According to CBRE Hotels Research, this is primarily due to slightly lower inflation expectations and a higher proportion of group travel and shoulder-period demand, which typically have lower rates.

CBRE's baseline scenario forecast envisages an average GDP growth of 0.8 percent and average inflation of 4.6 percent in 2023. Given the strong correlation between GDP and RevPAR growth, changes in the economic outlook will directly impact the performance of the lodging industry, CBRE noted.

“We are already starting to see signs that the easing of travel restrictions in Japan and China, combined with continued improvements in group and independent business demand, are bolstering demand heading into the heavy summer travel season,” said Rachael Rothman, head of hotel research & data analytics at CBRE.

Positive GDP growth

Despite the economic headwinds, the U.S. economy grew at an annualized rate of 1.1 percent in the first quarter, marking the third consecutive quarter of positive GDP growth, CBRE said. “The uptick in economic growth led to a record first quarter for U.S. RevPAR at $88.33, reflecting a 15.5 percent year-over-year increase from the first quarter of 2022. The RevPAR growth was primarily driven by a 9.6 percent rise in ADR and a 3.1 percent increase in occupancy over the previous year. The quarter’s strength can be attributed to the ongoing improvement in group business, inbound international travel, and traditional transient business demand.”

Considering the impact of COVID restrictions on hotel fundamentals in the first quarter of 2022 and an expected deceleration in GDP growth during the second half of 2023, CBRE expects RevPAR growth to moderate to 4-5 percent over the coming months and further decelerate to the 2-3 percent range in Q4 2023.

“Despite the moderating pace of GDP growth, several travel-specific tailwinds coupled with employment growth and wage increases should result in another record year for RevPAR in 2023,” said Michael Nhu, senior economist and CBRE’s head of global hotels forecasting. “The combination of inflationary pressures and higher interest rates are leading to slower hotel supply growth and further strengthening the pricing power of existing hotels.”

CBRE forecasts that U.S. hotel supply will increase at a compound annual growth rate of 1 percent over the next five years, below the industry's long-term historical average of 1.6 percent.

In its November 2022 Hotel Horizons forecast, CBRE projected a 5.8 percent increase in RevPAR in 2023, up from its previous forecast of a 5.6 percent increase in RevPAR for 2023.