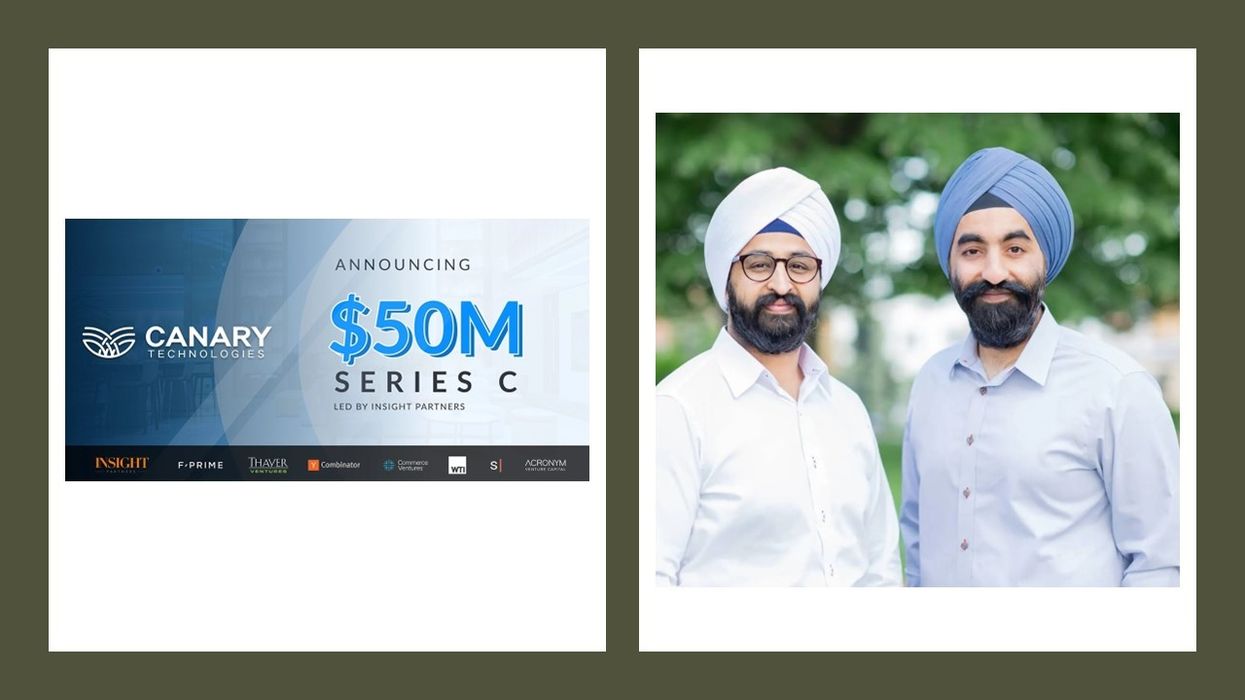

HOSPITALITY SOFTWARE PROVIDER Canary Technologies recently closed a $50 million Series C funding round to research AI guest technology in the hospitality sector, bringing its total fundraising to nearly $100 million. The company's software includes mobile check-in and checkout, tablet registration, upsells, guest messaging, Canary AI and digital tipping.

The recent investment round was led by global software investor Insight Partners, who also led the company’s Series B, with participation from existing investors F-Prime Capital, Thayer Ventures, Y-Combinator and Commerce Ventures, Canary said in a statement. California-based Canary is led by CEO Harman Singh Narula and President SJ Sawhney.

“AI is transforming the way we live, work and travel,” said Narula. “Canary is at the forefront of delivering enterprise-grade hospitality AI solutions that empower hoteliers to streamline operations, boost efficiency and elevate the guest experience, This funding milestone is a reflection of the team’s hard work and the immense impact that Canary is making for hoteliers, including many of the world’s largest enterprise hotel brands. We continue to see significant demand in the market for our products and are excited to extend our partnership with existing investors.”

Canary’s hotel tech stack includes an end-to-end guest management platform that digitizes processes from post-booking through checkout, the statement added.

“In a year that proved tough on growth and execution in the tech ecosystem, we saw Canary thrive and exceed their ambitious targets, prompting us to double down,” said Thomas Krane, Insight Partners’ managing director. “We continue to be impressed with Harman, SJ and the team’s tenacity and ability to deliver hoteliers the best-in-class solutions they need most and are honored to be a part of the company’s journey.”

Canary serves more than 20,000 hoteliers in more than 80 countries, including Marriott International, Four Seasons Hotels and Resorts, Choice Hotels, Wyndham Hotels & Resorts, Rosewood Hotels & Resorts, and InterContinental Hotels Group.

“Canary remains focused on our mission of helping hoteliers modernize their tech stack to deliver the best guest experiences possible,” said Sawhney. “We are thrilled to utilize the funding to continue building a world-class team focused on innovation while expediting our ambitious roadmap. With Canary AI already deployed in some of the world’s largest enterprise hotel brands, we look forward to further enhancing our AI capabilities and broadening its use across the industry.”

IHG Hotels & Resorts recently chose Canary as its global digital tipping solution, enabling guests to tip hotel staff.