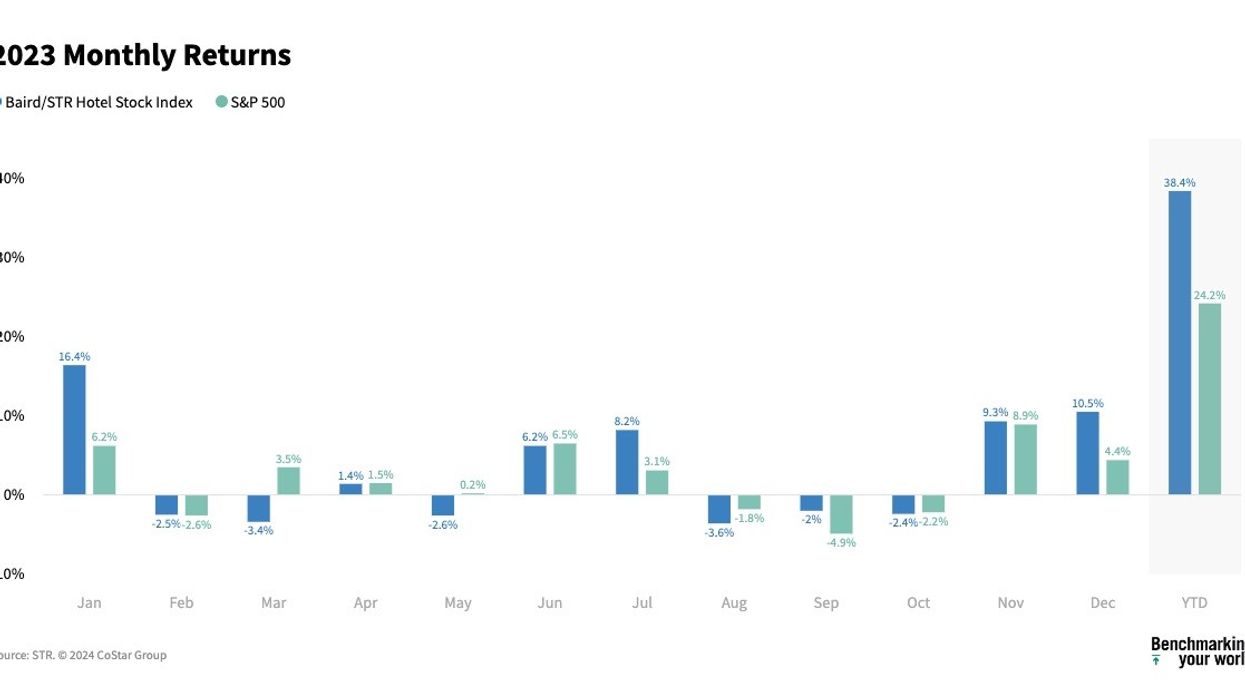

THE BAIRD/STR Hotel Stock Index rose 10.5 percent to 6,760 in December, according to STR. Moreover, the stock index closed the year with a 38.4 percent gain in 2023, driven by a favorable interest rate outlook boosting investor sentiment and valuation multiples.

“Hotel stocks – like the broader market – finished 2023 on a high note as the ‘soft landing’ narrative and lower interest rate outlook continued to boost investor sentiment and valuation multiples,” said Michael Bellisario, senior hotel research analyst and director at Baird. “Both the hotel brands and hotel REITs were up more than 10 percent in December and outperformed their respective benchmarks. For the year, the hotel REITs’ 19 percent gain more than doubled the return of real estate stocks broadly, while the hotel brands’ 44 percent increase nearly doubled the performance of the S&P 500.”

The U.S. hotel industry closed the year on a strong note, said Amanda Hite, president of STR.

“RevPAR rose 5 percent from the previous year, with growth driven by the first quarter’s 10.4 percent increase due to a comparison against Omicron-impacted months in 2022,” Hite said. “In the remaining quarters, RevPAR growth averaged 3.1 percent, which is above the long-term quarterly average of 2.9 percent. Occupancy continued to close the gap to 2019 levels, while absolute ADR and RevPAR remained well above that benchmark on a nominal basis and narrowed the gap on an inflation-adjusted basis. Overall, it was a solid and ‘normal’ year for the industry.”

In December, the Baird/STR Index outperformed both the S&P 500 (up 4.4 percent) and the MSCI US REIT Index (up 9 percent), STR said. Alongside, the hotel brand sub-index climbed by 10.4 percent to 12.841, while the hotel REIT sub-index experienced a robust 10.6 percent surge, reaching 1,236.

In November, the Baird/STR Hotel Stock Index surged 9.3 percent to 6,119, fueled by lower interest rates for real estate stocks and positive investor sentiment. However, U.S. hotel demand declined, attributed to reduced group travel during Thanksgiving week.