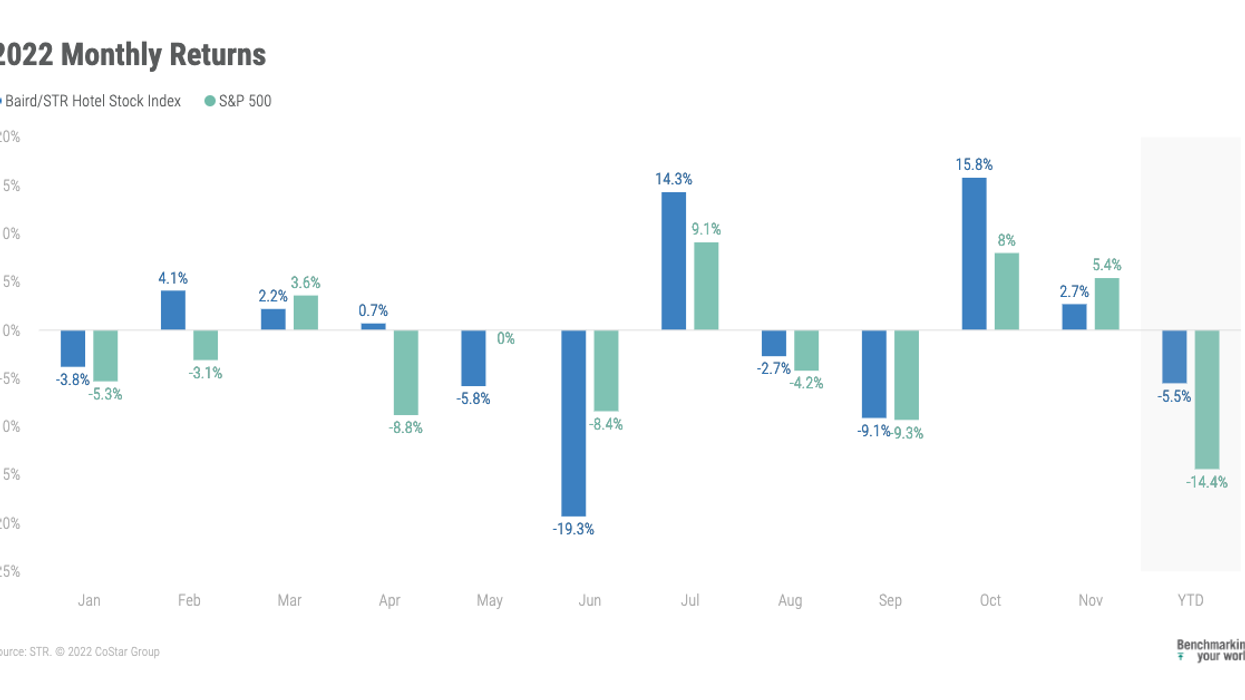

THE BAIRD/STR Hotel Stock Index rose 2.7 percent in November according to STR. However, hotel stocks were relative underperformers during the month for the first time since June.

The index jumped 15.8 percent in October. The index was down 5.5 percent year-to-date through the first 11 months of 2022. In November, the Baird/STR Hotel Stock Index fell behind both the S&P 500, up 5.4 percent and the MSCI US REIT Index, increased 5.6 percent.

The hotel brand sub-index increased 3.7 percent from October to 9,804, while the Hotel REIT sub-index fell 0.2 percent.

“Hotel stocks increased in November but were relative underperformers for the first time since June,” said Michael Bellisario, senior hotel research analyst and director at Baird. “Softer than expected CPI data fed into the Federal Reserve pivot narrative, which caused the broader stock market to jump, particularly in some of the industries and sectors that had lagged recently; as a result, both the hotel REITs and the global hotel brands underperformed their respective benchmarks. Hotel fundamentals broadly continue to hold steady, but the rate of change on the top line has moderated. Following third-quarter earnings, expense pressures now are more in focus, particularly as investors focus on 2023 growth outlooks and potential risks to the overall recovery.”

"U.S. hotel room demand continued to improve in November, but year-over-year growth slowed compared to October due in part to the calendar shift around Halloween," said Amanda Hite, president, STR. "Similarly, rate growth remained robust, albeit at a slightly slower pace than the previous month. Despite the slowdown in growth, nominal RevPAR remained above the pre-pandemic comparable while inflation-adjusted RevPAR was just four percent lower than 2019. While we continue to monitor the inflation impact and likely recession, the resilience of the industry allowed us to maintain our previous projections for ADR and RevPAR in our final forecast of the year."