THE BAIRD/STR Hotel Stock Index rose in March, continuing a trend from the previous month. Still, continued growth remains at risk by factors such as inflation and political unrest.

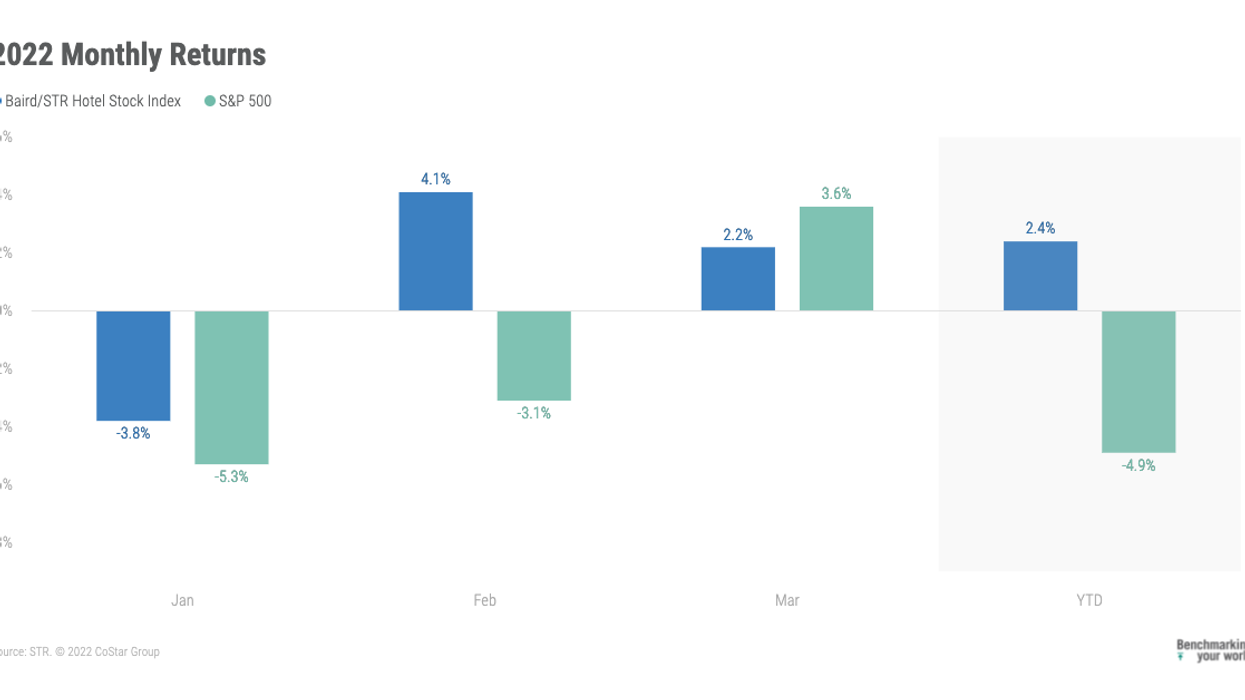

The index increased 2.2 percent in March after rising 4.1 percent in February. It rose 2.4 percent year to date through the first three months of 2022. However, Baird/STR fell behind both the S&P 500, up 3.6 percent in March, and the MSCI US REIT Index, which rose 5.9 percent. The hotel brand sub-index rose 1.4 percent from February, while the Hotel REIT sub-index jumped 5.1 percent.

“Hotel stocks increased in March but underperformed their benchmarks as stock market volatility eased and geopolitical concerns did not worsen,” said Michael Bellisario, senior hotel research analyst and director at Baird. “Underlying hotel fundamentals continued to improve in March, and the outlook appears more favorable today than just one month ago despite all of the background noise in the stock market and with interest rates on the rise. Higher gas prices and heightened concerns about a slower growth backdrop have been topical with investors lately, but broader travel momentum and pent-up demand should keep the lodging recovery going over the near term, in our opinion.”

That recovery still depends on several factors, said Amanda Hite, STR’s president.

“With a strong spring break, and continued improvement in business travel, all eyes are now on the spring meeting season,” Hite said. “Midweek flight numbers and hotel occupancies continue to show improvement, hinting at continued return-to-office momentum and healthier corporate demand. Week-to-week volatility in key performance indicators, which was normal pre-pandemic but then totally absent for the last two years, is also returning, hinting at a further normalization in travel patterns. Our research indicates that higher gas prices are not a deterrent to leisure travel, as consumers may make different travel choices but will likely not abandon their trips all together. The latest profitability data also shows ongoing improvement now that the impact of the Omicron variant is subsiding, but labor costs and availability continue to be top of mind for operators.”