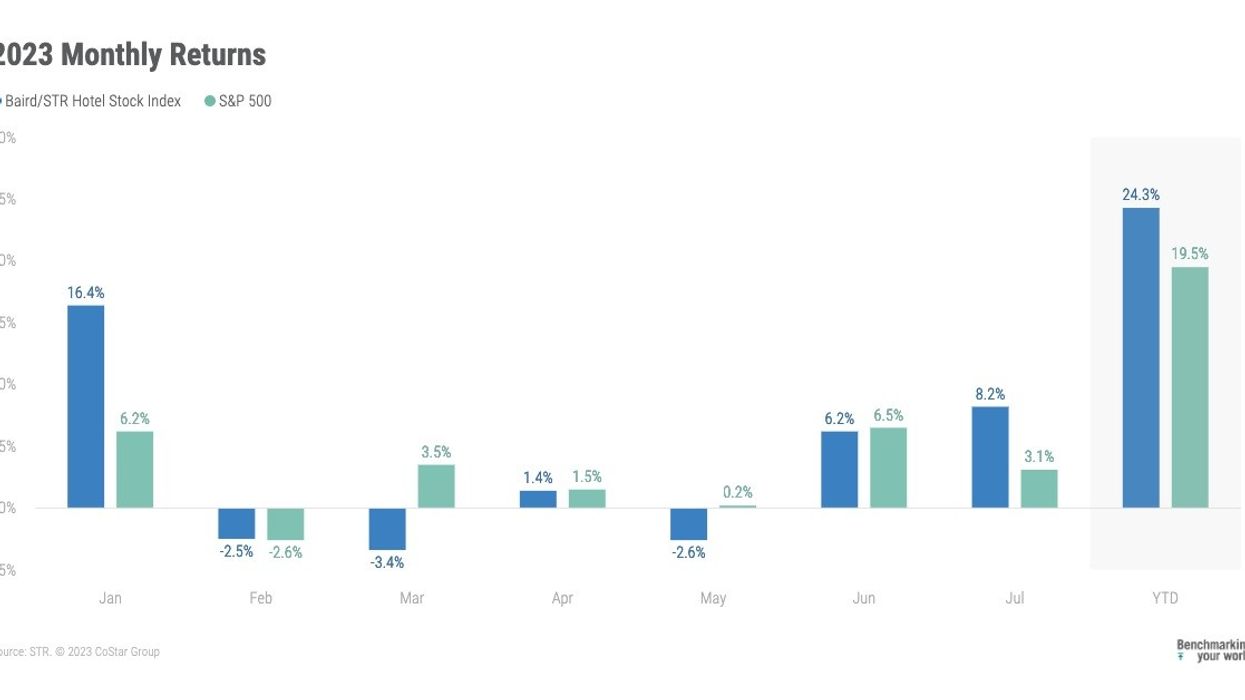

THE BAIRD/STR Hotel Stock Index soared 8.2 per cent in July, reaching 6,074 as global hotel brands take the lead, according to STR. The composers of the index say it is benefiting from an overall rise in the market.

"Hotels stocks displayed another strong performance in July, with global hotel brands leading the way," said Michael Bellisario, director and senior analyst for hotel research at Baird. "In recent months, the hotel stocks' performance has been supported by broader stock market momentum and investors' increased risk appetite. Moreover, the recovery of international strength and cross-border travel has particularly benefited the global hotel brands. While hotel REITs face challenging growth comparisons for the rest of the year, recent adjustments in investor expectations now more accurately reflect this moderated growth outlook, in our opinion."

“Demand was basically flat year over year, which has been the trend for the last three months or so,” said Amanda Hite, STR president. “However, the industry is still in recovery mode, and the lower growth we're seeing this summer is more about a return to normal as opposed to a weakening in performance. The top 25 markets continue to see demand strengthen whereas all other markets have fallen back to more traditional levels of performance. ADR and RevPAR advanced in July but at the lowest growth rates of the post-pandemic era.”

The Baird/STR Index surpassed both the S&P 500, which rose by 3.1 percent, and the MSCI US REIT Index, which saw a gain of 2.7 percent. The hotel brand sub-index surged by 9.0 percent from June, reaching 11,492, while the hotel REIT sub-index expanded by 5.3 percent, reaching 1,129.

In June, The Baird/STR Index rose by 6.2 percent, reaching 5,615. Economists from both agencies pointed to this as an indicator of reduced recession risks this year.