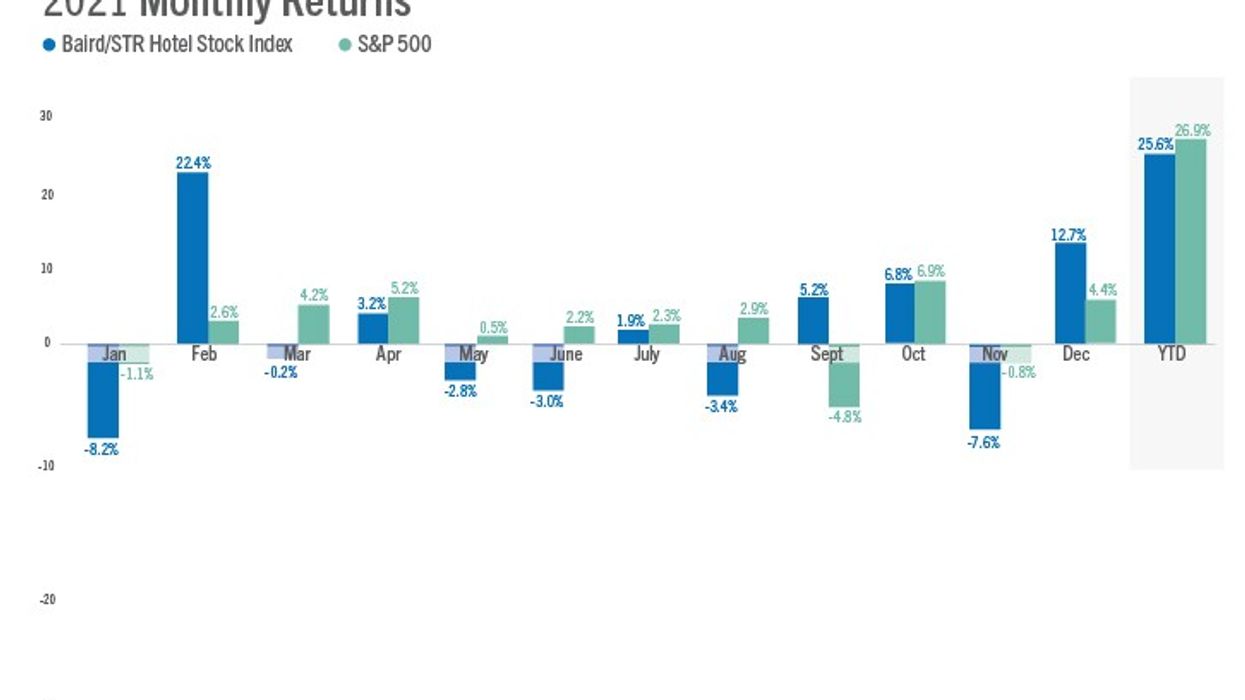

THE BAIRD/STR Hotel Stock Index rose 12.7 percent in December over the previous month. It was up 25.6 percent for 2021 as a whole.

The index outperformed both the S&P 500, up 4.4 percent, and the MSCI US REIT Index, which rose 8.2 percent in December. The hotel brand sub-index increased 13.2 percent from November while the Hotel REIT sub-index rose 10.9 percent.

Investment was bolstered by some, if not good, then less bad than expected news regarding the COVID-19 pandemic, said Michael Bellisario, senior hotel research analyst and director at Baird.

“Hotel stocks ended a volatile year with strong gains in December as the worst-case scenarios related to the Omicron variant appeared unlikely to unfold as initially feared,” Bellisario said. “With the big rebound into year-end, the hotel brands ended up slightly outperforming the S&P 500 in 2021, while the hotel REITs – despite gaining 12 percent on the year – significantly lagged the RMZ’s best-ever annual performance. Turning the calendar to 2022, leisure travel strength is expected to persist, but the wildcard for the overall industry’s continued recovery remains a more substantial return of the business traveler.”

Other factors drove the rise in investment, said STR president Amanda Hite.

“Holiday travel came through once again and drove U.S. hotel occupancy to an all-time Christmas high and ADR to record-highs leading up to New Year’s,” Hite said. “Despite disruptions in the airline industry, we have not seen a significant impact from the Omicron variant on the overall U.S. hotel industry. With the new year among us, we can expect a continued recovery in performance, with more pronounced upticks in urban locations when in-person meetings resume. The stronger-performing locations throughout the pandemic, beach and mountain destinations, are anticipated to keep that momentum into the new year as leisure travelers embark on spring break or quick weekend getaways.”