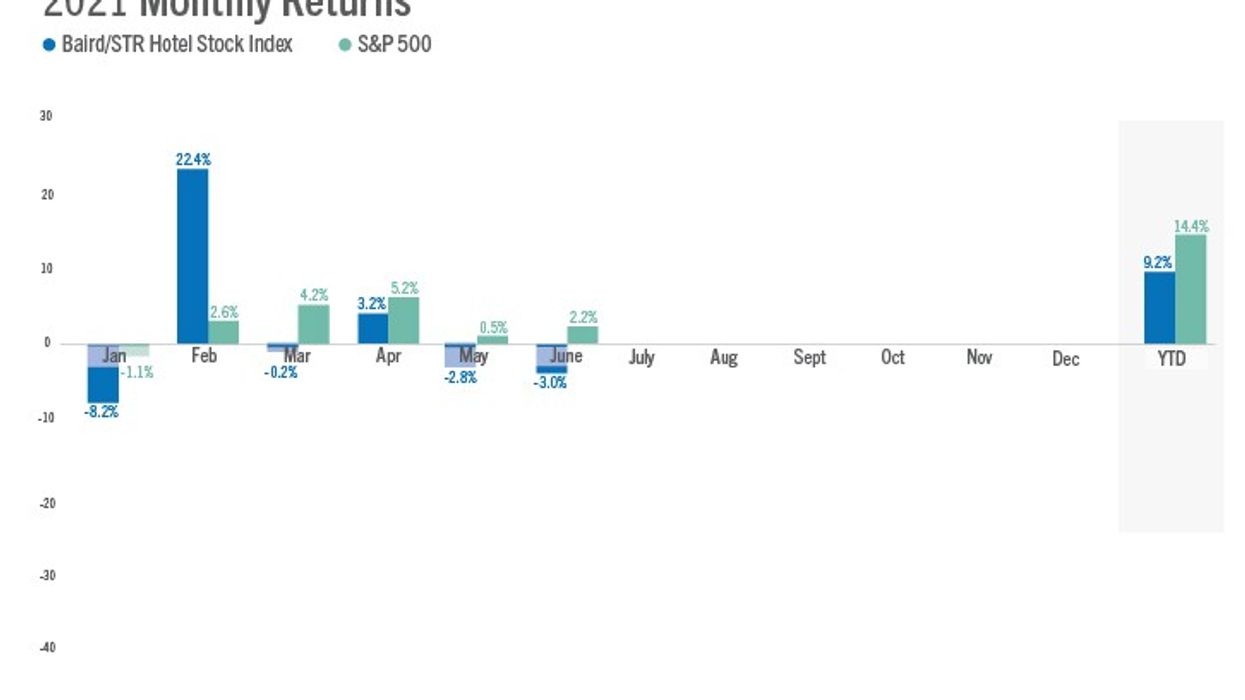

THE HOTEL STOCK rollercoaster continued its downhill slide in June, according to the Baird/STR Hotel Stock Index. The 3 percent drop came as a surprise to one expert and could reflect concern about how the market will perform after the current summer surge in leisure travel ends.

At the same time, the index rose 9.2 percent year to date through the first six months of 2021. June’s decline followed a 2.8 percent drop in May.

The Baird/STR Index fell behind both the S&P 500, which rose 2.2 percent, and the MSCI US REIT Index, up 2.2 percent, for the month. The hotel brand sub-index decreased 3.9 percent from May to 8,516, while the Hotel REIT sub-index dipped 0.4 percent to 1,294.

“Hotel stocks declined again in June and continued their relative underperformance versus the benchmarks for the fourth consecutive month,” said Michael Bellisario, senior hotel research analyst and director at Baird. “Despite continued sequential fundamental improvement and strengthening demand trends, especially domestically, hotel stocks have been laggards since the reopening momentum peaked in March. Investors remain focused on stock valuations, the near-term outlook for business travel, and the non-linear and still-uncertain broader global recovery.”

June’s underperformance by the index is surprising in light of the fact that the industry fundamentals are experiencing an ongoing upward movement, said Amanda Hite, STR president.

“If aligning industry performance with investor sentiment, it would seem there is less focus on the uptick in leisure-driven segments and more concern around the persistent lack of business travel and group demand,” Hite said. “While leisure markets are reaping the benefits of the U.S. summer travel surge, the major metros and big-box hotels are still stuck near the recovery start line—that is preventing more substantial recovery for the industry as a whole. There are indicators for improvement in those segments later this year.”

As of June 16, Ashford Hospitality Trust replaced Extended Stay America in the Index. In addition, ESA was removed from the brand sub-index and AHT was added to the REIT sub-index.